First off, we aren’t having a recession. If you run into an accountant at a local cocktail party and he’s surrounded by people waiting to hear his thoughts on how the economy is going to dive, you can just shut him down right now.

In fact, not only do I believe we aren’t headed for a recession… I believe we’re actually going to hit the accelerator on the economy in 2020.

This month, I’ll discuss what a recession is and why there will NOT be one in 2020. Then with that out of the way, I’ll provide the super-industries that I expect to grow tremendously in the coming years.

“We’re actually going to hit the accelerator on the economy in 2020.”

The DNA of a Recession

Let’s look at the characteristics of pretty much every recession.

WALL STREET GOES WILD

Every time we’ve entered a recession, it’s because Wall Street went wild.

Meaning, some financial innovation spiraled out of control and went crazy.

1981: Three oil crises in a row sent oil to all-time highs. (1973, 1979, and the Iranian Revolution.)

This, in turn, sent inflation to huge highs, which drove up interest rates and caused everyone to fire everyone and stop spending money. And that caused a massive recession.

1991: The financial innovation that went crazy was junk bonds.

Banks, led by Michael Milken, convinced the market that junk bonds weren’t actually junk (i.e. they didn’t default as much as people thought). So banks start lending money for the craziest reasons and everyone was a buyer.

Guess what? Junk is junk. Eventually, people couldn’t pay banks, so banks stopped lending. The entire Ponzi scheme fell apart… causing a recession.

2001: You may think Wall Street going wild this time had to do with the internet boom… but that’s not the case. The internet boom SHOULD have boomed. It’s a multi-trillion dollar industry.

Instead, the real issue was the scummy IPO boom. I have a dog named “Wookie.” If I had changed her name to “Wookie.com” Goldman Sachs would have pitched me on taking her public in an IPO and I’d make a ton of money.

Hundreds of these BS companies went public. And eventually, as the cliche goes, the tide came in and everyone was naked. These BS companies went bankrupt, causing dozens of mid-tier investment banks to go bankrupt, causing unemployment — and one of the mildest recessions in history.

2008: Before 2008, we had the enormous rise of credit default swaps.

The housing bubble actually had already peaked in 2006. The real issue in 2008 was the financial innovation of placing bets on top of bets on top of bets ABOUT housing prices. This had never occurred before.

Basically, banks would combine 100,000 mortgage loans into one bond, sell it to a hedge fund, and then other hedge funds would bet on that bond going bankrupt, and other hedge funds would bet that those bets would fail.

In summary, if housing prices even fell 1%, the entire system would collapse. Because nobody understood what this financial innovation was really doing. HIGH INTEREST RATES The Federal Reserve typically raises interest rates to fight inflation.

And when interest rates are high, it’s better to save money than spend money. If I can make 8% a year putting my money in the bank, and the stock market typically returns around 8% a year (but with much more risk), than I am not going to invest in the stock market.

And I will probably not borrow money to buy a house (and pay 12% interest on my mortgage) or use money on my credit card to buy things (at 20% interest).

So the economy goes down.

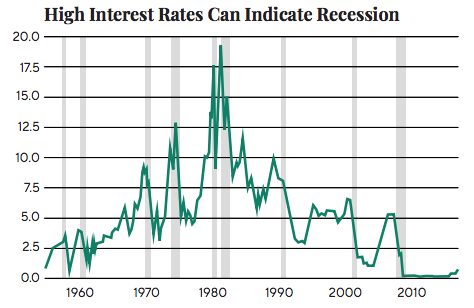

The chart below matches interest rates with recessions. The Federal Reserve interest rates are marked in dark green, recessions are marked in gray. Note that before every gray recession area, there is a SUBSTANTIAL increase in interest rates.

Four Reasons We’re Not Entering Recession

Four things have happened that will not only prevent recession in the next year, but actually hit the accelerator on the economy.

1) RECENT DEREGULATION OF THOUSANDS OF LOCAL AND REGIONAL BANKS

After the 2008 crisis, banks got regulated. Meaning, banks were required to hold more cash rather than lend it out. In other words, they had to play it safe. Recently, regional banks have been waived from those regulations. So they can now lend more money to people who want to buy houses. Lending more money means people will spend more money rather than save it, which means the economy will grow more than was expected.

2) THE FEDERAL RESERVE

Appropriately or inappropriately, Trump is leaning on the Federal Reserve to not raise interest rates. We have never seen a recession EVER with interest rates this low. But it’s not just that…

3) TAX REPATRIATION

The recent tax bill gives a tax holiday to companies that have money abroad — they can bring the money back stateside for a one-time lower tax rate. In 2018, companies brought back $465 TRILLION. This translates to a 3% uptick in domestic cash. Some of that money will certainly get spent in the next year or so. How come? Low interest rates. Companies would rather invest the money than get no return on it. And stock market investors don’t like investing in companies that are just sitting on cash/making no money. In a $15 trillion economy, a 3% sudden uptick in cash is enormous. GDP growth averaged 1-2% per year over the past 10 years. What if suddenly there is a year with 5% GDP growth? A lot more wealth will be created. And that leads me to one final point…

4) THE MONEY MULTIPLIER

This is a basic economics principle: Every dollar put into the economy grows the economy by somewhere between $5-10. How can this be? If I buy a bagel at the store in the morning, the bagel guy can take the same dollar and buy a newspaper. The newspaper guy can take the same dollar and buy a flower for his wife. She can take the same dollar and buy gas for the car. The gas attendant can take the same dollar and buy a toy for her kid. And so on.

That’s one dollar, passed around many times, causing on average $5-10 in growth. So as crazy as it sounds, there’s enough PUSH into the economy to potentially see economic growth in 2020 unlike anything we’ve seen in our lifetimes.

And this makes sense. For better or worse, Trump has a potentially difficult election coming in 2020.

He knows that people vote for their pocketbooks. So he wants people to feel flush. He is basically carpet-bombing the economy with dollars over the next year.

Whether you think this is a good policy or not, it will ensure that 2020 is an enormous year for growth.

So… as investors, what do we do about it?

First and foremost, we turn to Moore’s Law for answers…

Moore’s Law for Exponential Growth

In 1966, a young CEO in a brand new industry made a prediction that amazingly has lasted for over 50 years. Gordon Moore was the CEO of Intel. And he predicted that computers would double in power every two years. That’s about 36% growth every year. By comparison, the oil industry grows about 1% per year.

Computers went from a tiny, tiny industry to an industry worth TRILLIONS today. It survived wars, impeachments, five recessions, terrorism, etc. — and it keeps growing. It’s amazing how accurate his prediction was.

Each doubling in power created entire new multi-billion dollar industries, ranging from PCs in every home, smart phones, rockets, smart electric grids, the internet of things (IoT), automated cars, virtual reality, high definition streaming, etc. etc. etc. etc.

Moore’s Law was dead on accurate. Right now, we are living in an amazing time. Several industries experience “Moore’s Law” exponential growth, growing at 25-40% per year with no end in sight.

If I were starting a hedge fund right now, I’d call it the “Moore’s Law Hedge Fund.” I’d invest in a basket of companies in each of the industries that are growing (and seek out other industries that are also growing exponentially) and do the hard work of avoiding the scams. And then… I’d wait.

If all you did was wait on the computer industry, a few thousand dollars invested in the handful of companies that were public would have returned millions of dollars.

No fancy trading strategies. No bullish signals. No chart analysis.

Just look for the Moore’s Law industries, avoid the scams, buy a basket of what’s left. Diversify across industries.

Here are a few industries experiencing Moore’s Law growth right now. Then I’ll perform a deep dive on one in particular.

The Top Industries to Watch in 2020

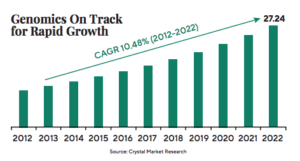

GENOMICS

Remember: Moore’s Law didn’t predict something about the computer industry itself, it predicted the power of computer chips. Meaning, one advancement in the industry ends up affecting the entire industry as a whole. The cost of sequencing the human genome has gone from over $100 million to less than $10. This is a massive advancement in technology. As a result, the underlying industry will grow rapidly ever the next 10 years. Genomics will be used to battle every major health care industry. Within 10 years, health care will be unrecognizable by current standards.

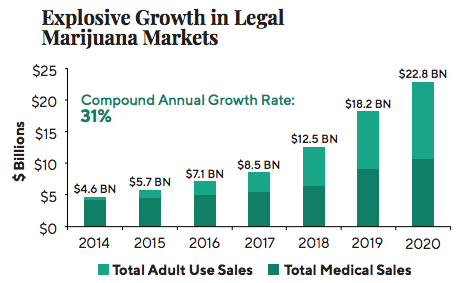

MARIJUANA

Marijuana use is fully legalized in 10 states and the District of Columbia. Soon, this will be true in all 50 states. After that, the entire world. Current growth is already exponential and will continue to be as:

• States legal it

• Countries legalize it

• More medical uses are discovered. Because of the current legal status, medical use has been almost impossible to test.

Soon that will change.

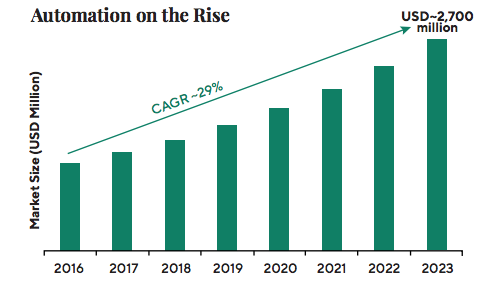

AUTOMATION

Automation is going to affect every single industry on the planet. And it’s already started.

Automated robots shelving at Walmart. Automated truck driving. Automated in machinery and factories. Etc. etc.

CLOUD STORAGE

Over 400 hours of video are added to YouTube every minute. That’s in addition to billions of photos, documents, and other content uploaded to streaming services and social media. Storage is needed for all of this data. And a rise in cloud storage also leads to further sub-industries such as cyber security, fast retrieval of that data, data analysis, etc.

The chart below highlights the growth of the cloud storage industry:

PLANT-BASED FOODS

The former CEO of Google Eric Schmidt was asked what he sees being the top five growing trends over the next decade. His No. 1 answer? Plant-based foods. The demand for plant-based alternatives to meat is driven by better technology, healthier diets, environmental concerns, and access to more knowledge about nutrition.

Here’s the growth chart:

Increased Demand for Plant-Based Food

Some of the biggest names in the food industry — Tyson, McDonald’s, Dunkin Donuts, etc. — are all experimenting with plant-based food products.

This trend is going to pick up massive speed in 2020.

The list doesn’t stop there. Artificial intelligence (AI), big data, solar power, energy storage… these are all industries that will provide investors with massive returns over the course of the next year.

There is no shortage of opportunities.

It doesn’t matter who is president. It doesn’t matter what happens in the economy.

It only matters that people continue to innovate. Since the Renaissance and the Industrial Revolution, innovation has been in a straight line moving up. This time things WON’T be different. Now, let’s dive deeper into one of these industries in particular. In future issues and updates, I’ll continue to do this.

Understanding the Massive Profit Potential of Genomics

I’m a big believer in idea sex. Taking two seemingly unrelated ideas and merging them together into a super idea.

In fact, right now, companies are bringing together the power of gene editing and machine learning to revolutionize the field of medicine.

And that’s exactly why one of the hottest emerging areas of investment today is the field of genomics.

For some background, genomics is the study of characterization of all of the genes of a species. Over the past 70 years, many of these genes were unidentified.

That is, until 2004 — when the Human Genome Project completed the sequencing of 92% of the human genome. The project took close to 10 years and billions of dollars to complete.

And yet, despite all this work, much of the individual characteristics of human genetics remain a mystery. While the genes for some traits (such as eye color) are easily identified, others (such as risk for specific diseases) are not.

To put this into perspective, the vast majority (99%) of DNA will be identical across all humans. Of the 3 billion pairs that compose human DNA, just 10 million of these pairs may vary. Of that, only 600,000 of these variants are well understood with associated traits. However, scientists are progressively unlocking the secrets of the remaining 9 million plus variations… The applications are various.

Developing disease resistant crops (including marijuana)… identifying mutations linked with cancer… informing the design of medication… developing biofuels for sustainable sources of energy… plastic-consuming bacteria for environmental conservation. I could go on.

And while genomics has been an exciting area of scientific progress since at least the 1950s, the trend has accelerated in recent years with the discovery of new gene-editing techniques and machine learning. Above all, the combination of these two tools allows for powerful new developments enabling the types of exponential growth predicted by Moore’s Law.

One specific gene editing tool, called CRISPR, has simultaneously set off a genomics frenzy in both the investment and scientific communities.

CRISPR enables biologists to selectively target and edit specific genes within organisms.

This technology is useful in its own right as a tool for developing genetically modified designer crops or organisms. But CRISPR’s potential also enables a tremendous potential to unlock many secrets of genomics for the first time.

For example, previously, scientists had to perform statistical analysis across many samples in order to determine the function of specific genes. While this has revealed plenty about the human genome, there are also serious limitations.

With CRISPR, scientists can test and analyze the results when modifications are made to discrete genes. Which is to say, CRISPR makes it easier for scientists to learn by trial-and-error changes to genes. And while this is an exciting development, the power of this tool is further amplified when combined with the power of machine learning and inexpensive genetic sequencing.

Medicine of the Future

To be more specific, the cost of genetic sequencing used to be astronomically expensive. Today, anyone can mail in a swab of the inside of their mouth and get their DNA genotyped for about two hundred bucks. This reduction in cost has enabled millions of people to get their DNA genotyped.

The commercialization of DNA genotyping has provided vast troves of information which could be analyzed to identify common patterns and associated traits.

However, despite all of the available data, the interpretation of many sequences remains a major challenge… for now.

In recent years, scientists have looked to leverage machine learning to scour these mountains of data to identify meaningful patterns.

As computers become more powerful like I discussed earlier, their ability to make sense of data is also growing.

Let’s look at a hypothetical example.

A biologist might be interested in identifying a gene associated with a particular type of cancer. Using machine learning, he or she might be able to identify specific DNA sequences unique to individuals with that particular type of cancer.

To further narrow and confirm the specific DNA sequences associated with that cancer, a scientist might run an experiment with CRISPR where he would alter the suspected sequences until he could pinpoint the exact source of the disease.

Right now, medicine focuses primarily on the 99% of DNA that is the same across almost all humans. Medicine of the future will be personalized.

It represents a radically different approach to health than we’ve experienced in our lifetimes. And from an investment standpoint, placing bets on the companies developing this technology can lead to unprecedented gains in the near future.