I’ve seen little mention of this stock anywhere — online, in newspapers, magazines, articles, or any mainstream news media source.

But it may be one of the most profitable marijuana stocks to ever hit the market…

And because it’s still creating the infrastructure that will undoubtedly garner the attention of some pretty serious institutional money — maybe even Canadian pension funds in the years to come — now is the perfect time to pay attention to it.

Thing is, HEXO Corp. (NYSE: HEXO) has made some enviable strides in the cannabis industry in just the past year.

It has:

- Recently partnered with a prominent alcobev Fortune 500 company and inked a deal to create a nonalcoholic CBD-based drink

- De-risked itself by ensuring 40% of its production is promised for the next five years

- Combined forces with a biotech company with an expertise in extraction.

And even more exciting than all of that is HEXO’s size… With a market cap hovering around $2 billion, its stock still trades in the small-cap range. That tells us we’re not paying a premium for this stock — that is, we’re not paying for its potential. In fact, it’s undervalued. Let’s first talk about HEXO’s background — and then we’ll discuss what it’s doing now that makes it a sleeper pick for your portfolio.

The First Generation of Pot Stocks

HEXO was founded in 2013 (around the same time as the five largest Canadian cannabis companies by market cap) and began selling medical marijuana under its Hydropothecary brand in May 2015.

Based in Gatineau, Quebec, HEXO Corp. is a vertically-integrated consumer packaged goods company in the medical and legal adult-use cannabis market.

Meaning it does everything itself — from growth to distribution.

And because HEXO developed a name for itself over the years, it was able to wedge itself a place in the new weed world by securing a five-year supply deal with the entire province of Quebec. Here’s what HEXO co-founder and CEO Sebastien St-Louis had to say when the supply agreement was announced:

“Becoming the preferred supplier to the Quebec market out of the gate post-legalization is a source of great pride and a vote of confidence in our ability to scale operations to meet our supply commitment. This agreement marks an important step in the execution of our growth strategy, which is focused initially on the Quebec market by expanding our Gatineau facilities and hiring new employees, and then establishing our presence in other Canadian markets.”

By and large, HEXO’s secret to success has been its foresight. It focused on striking important deals regionally and internationally.

For example, in August 2018 HEXO purchased Newstrike Brands, another licensed producer and cultivator of cannabis. That purchase supplied them with nearly 500,000 square feet of greenhouse growing space, bringing HEXO’s total growing space to 1.8 million square feet. T

hen in September, the company bought 33% of Greek cannabis manufacturer, HEXOMed, wiggling its way into the European market.

In April 2019, the company closed on a supply agreement with biotech extraction company Valens GroWorks, promising to work together for two years. Valens GroWorks will be creating resins and distillates for HEXO, in anticipation of Health Canada’s imminent decision regarding food and beverage infusions.

HEXO made marijuana history when it announced a joint venture with Molson Coors Brewing Company — the world’s seventh largest brewer by volume.

As a result, HEXO’s stock doubled in the space of two months.

Molson Coors purchased 57.5% of HEXO, with the joint goal of creating nonalcoholic cannabis-infused beverages.

Truss, their shared business, is still on track to introduce a line of products by October 2019.

This is not only exciting news for Molson Coors and HEXO — it’s exciting news for the industry itself.

Constellation Brands soon followed suit, investing in Canopy Growth Corp. for a similar purpose. So did Anheuser-busch InBev when it heavily invested in Tilray. Of course, none of those companies can really compete in the beverage space until Health Canada makes a definite call regarding edible cannabis products and beverages. But HEXO has been wise enough to spread its business through multiple sectors while it waits for Health Canada.

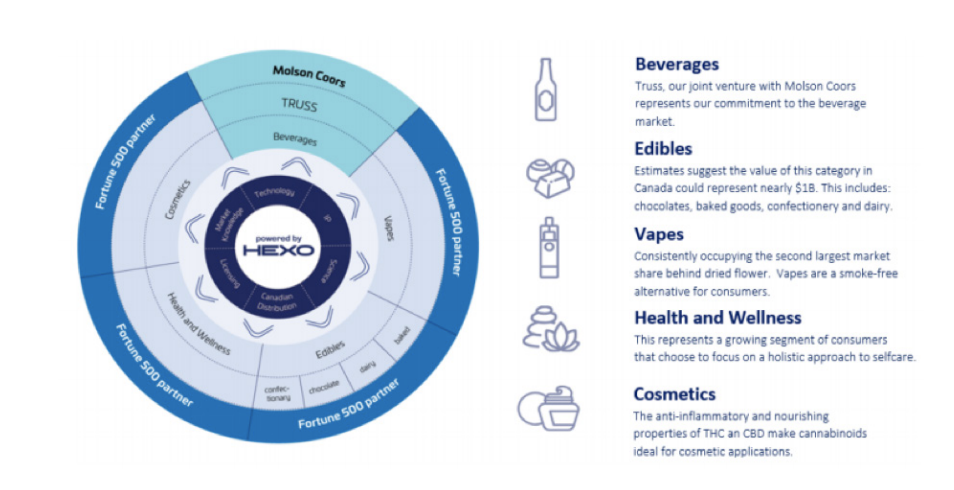

In the meantime, HEXO makes its bones from the dried flower it grows and supplies to its medical brand, Hydropothecary. Take a look at this depiction of HEXO’s partnerships in the health and wellness, vaping, edible, cosmetic, and beverages space:

Take a look at this depiction of HEXO’s partnerships in the health and wellness, vaping, edible, cosmetic, and beverages space:

Clearly, HEXO leaves no stone unturned. Its spoke-and-wheel business model accounts for five different areas of the marijuana market in which the company plans to integrate its supply.

And HEXO’s popularity throughout Canada cannot be overstated.

Quebec cannabis users are exclusively accustomed to HEXO’s brand — an impressive feat. Brand loyalty is a tricky thing to accomplish when advertising restrictions on cannabis in Canada remain strident and unforgiving.

Even more impressive, most of these strategic business moves happened in 2018. For nine months of that year, cannabis still wasn’t legal in Canada.

Fast forward to today, HEXO is rising to the occasion to meet 2019’s unique set of challenges.

Staying the Course

So far this year, HEXO has announced year-over-year growth of 1,269%.

Its stock shot up 125% in 2019 alone. Obviously, those are phenomenal numbers. But it gets even better.

Like I said earlier, its stock price reflects a serious undervaluation, considering its market cap is around $2 billion.

It’s already ahead of its competitors in the infusion race, given that the company started at least four months earlier than the rest of them.

As such, HEXO has the space to rank sixth among Canadian marijuana producers in terms of total growing capacity.

Bottom Line: If you consider HEXO’s partnerships and grow space, its potential for gains is much stronger than cannabis companies that are already considered the “blue-chips” of the industry.

It’s easy to see why HEXO is poised to emerge a market leader… and why getting in now matters significantly. Recommendation: Buy shares of HEXO up to $6.