How To Make Up To 30,666%

With marijuana legalization in full swing in Canada and several U.S. states…

And marijuana and hemp becoming increasingly useful in industry, medicine, and recreation…

The demand for weed is projected to soar over 3,500% in the coming years. And flat out — marijuana producers just can’t keep up.

In fact, financial journalist Charles Kennedy reported that in the next 12 months, Canada will only be able to produce 7% of the amount of marijuana Canadians are expected to consume.

And when you factor in the massive quantities that the U.S. will require…

The shortage we’re about to see will be staggering.

Now… I want you to imagine how much marijuana one single Costco store could produce, given its size and space.

Do you have it in your head?

Great. Now imagine how much nine Costco stores could produce.

All of a sudden, it looks like there’s a solution to the Boston Herald’s prediction that:

“Legal pot demand could outpace state supply, reigniting the illegal market…”

This type of operation — capable of propelling legal weed into the stratosphere — is fact, not fiction.

Let me introduce you to the blossoming marijuana company that refuses to let us return to the dark ages of black-market marijuana…

The Walmart of Weed: Auxly Cannabis Group Inc. (OTCBB: CBWTF)

Up until very recently, progressive entrepreneurs and lifelong cannabis enthusiasts assumed that growing cannabis would result in untold riches.

Today, we know that cannabis the plant is on its way to becoming another run-of-the-mill commodity. Big money isn’t going to be made in cultivation.

You see, while every cannabis company needs biomass, flower, and extracts to manufacture their products, the big money is in branding.

Anyone can grow cannabis (just ask my neighbor Steve). It’s those companies that can effectively market and brand their products that will rise to the top of the cannabis sector.

Its gargantuan size aside, there are many other reasons to pay attention to Auxly. Those reasons include that it:

- Takes in 1 million pounds of weed a year, amounting to roughly $5 billion in annual sales

- Trades for less than a dollar

- Produces marijuana for 50% cheaper by adopting a “royalty” method that allows it to have multiple streams of product and slash production costs from the standard $6.20 per gram to $2 per gram

- Has 17 streams of marijuana

- Has access to two million square feet of available grow space.

And that’s only scratching the surface…

Auxly’s Industry-leading Product Development Pipeline

Headquartered in Vancouver, Canada, Auxly Cannabis Group Inc. is an international cannabis company that’s dedicated to bringing innovative, effective, and high-quality cannabis products to the medical, wellness, and adult-use recreational markets.

The company is led by industry experts: Canopy Growth co-founder and Auxly chairman and previous CEO Chuck Rifici and company president and new CEO Hugo Alves. Under their leadership, Auxly Cannabis Group has secured a supply pipeline of over 100,000 kg of annual cannabis cultivation capacity through a combination of wholly-owned subsidiaries, streaming agreements, joint venture partnerships, and commercial offtake arrangements. Auxly isn’t trying to supply Canada and the international community with dried flower… Because frankly, that’s not where the money will be made. Sure, Auxly will realize a small amount of revenue via cannabis sales through its wholly-owned Kolab retail store in Lloydminster, Saskatchewan. But the company’s primary focus is building brands and preparing to dominate Canada’s phase two cannabis legalization market.

Auxly’s product development strategy is simple – though it’s taken a lot of time, strategizing, and investment to perfect.

Strategic Partnerships: A Match Made in Cannabis Heaven

In May 2018, at the cost of C$38 million, Auxly acquired Dosecann.

The acquisition provided Auxly with both the necessary personnel and state-of-the-art processing facility capable of turning raw cannabis into a variety of derivative cannabis products.

Dosecann’s ability to extract and perform quality testing, its research and development capabilities, and its expertise in product formulation and manufacturing give Auxly a competitive advantage over many of its peers heading into Canada’s phase two cannabis legalization.

Shortly after the Dosecann acquisition, in August 2018, Auxly further advanced its product development strategy by acquiring KGK Science Inc. for C$12.3 million.

KGK Science has worked with a variety of North America’s leading nutraceutical companies, natural health products companies, and consumer packaged goods companies – such as Kraft Foods, Sanofi, Nature’s Bounty, and NuSkin – for nearly 20 years, helping each company substantiate claims for their products.

KGK’s specialty lies in its ability to provide randomized clinical trials, in addition to research services like participant recruitment, regulatory compliance solutions, research support services, and general consulting.

It’s essential to remember that the green revolution isn’t about getting high. It’s about optimizing health, wellness, and the overall quality of one’s life.

And thanks to the acquisitions of Dosecann and KGK, Auxly can provide its medical cannabis patients and adult-use clients with safe, effective, and high-quality cannabis products.

Planting the Seeds for Market Domination

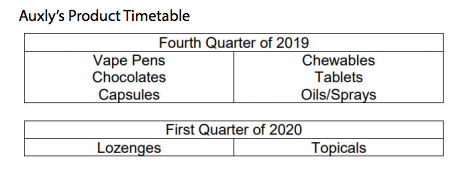

As far as a product timetable is concerned, Auxly expects to have vape pens, cannabis-infused chocolates, capsules, chewables, tablets, and oils/sprays available in Q4 2019 – pending receipt of regulatory approvals.

Cannabis-infused lozenges and topicals are likely to be released during Q1 2020.

Auxly isn’t waiting for Canada’s phase two cannabis legalization to go into effect to begin working.

The Auxly team is already putting the finishing touches on products intended for Canada’s medical and adult-use market. All it’s waiting for now is the official regulatory approvals and the go-ahead from Health Canada.

Following the Smart Money

Investing isn’t always about finding an unknown company in a hot industry that’s hiding in plain sight.

Sometimes the best approach is to ride the coattails of an investor that’s already made a massive investment and has millions of dollars riding on the success of the company you’re interested in.

Well, on July 25, 2019, Auxly announced that British multinational tobacco giant Imperial Brands was investing approximately C$123 million into Auxly by way of a convertible debenture.

Additionally, Imperial Brands is granting Auxly global licenses to its vaping technology and access to its vapor innovation business, Nerudia.

The convertible debenture has a threeyear term and a fixed interest rate of 4% per year. And Imperial Brands has the right to convert the debenture into Auxly shares at a price of C$0.81 at any time during the three-year term.

That C$0.81 exercise price is based on Auxly’s shares that trade on the Canadian TSX Venture Exchange. If Imperial Brands was converting its debenture into shares traded on the OTCBB, the conversion price would be approximately $0.62.

If at the end of the term Imperial Brands has not exercised its right to convert the debt into Auxly stock, the debt will be repaid in full.

Now, whether or not the Imperial brands chooses to exercise its right to convert its debt into Auxly shares will likely be determined by where Auxly’s shares are trading toward the end of the three-year term.

However, companies don’t invest millions of dollars for single-digit returns.

A 4% return on a C$123 million investment isn’t going to move the needle for a company with tens of billions (British pounds) in annual sales like Imperial Brands.

So it stands to reason that Imperial Brands believes in Auxly’s growth strategy and wants to be a major shareholder in the company within a few years.

Here’s what Chuck Rifici, chairman of Auxly, said about Imperials decision to invest in his company:

“Following its extensive evaluation of the Canadian cannabis market, we’re thrilled that Imperial Brands selected Auxly as its partner of choice due to the high caliber of our assets, people, and capabilities. We are particularly excited to partner with Imperial Brands on current and future intellectual property and product development, starting with immediate access to its portfolio of vaping technologies and research and development capabilities.”

Matthew Phillips, Imperial’s chief development officer, echoed Chuck’s enthusiasm by saying:

“Auxly’s unique assets and capabilities, including strong science and product development credentials, make it an ideal partner for Imperial in the legal Canadian cannabis market.”

Bottom Line: For the past two years, consumer packaged goods companies, Big Tobacco, and established alcohol have been combing the cannabis industry for strategic investments. And this has helped fuel and replenish the coffers of the companies receiving the investment dollars and legitimizing the cannabis industry.

But because the cannabis industry has endured a difficult summer of share price declines across the board, Imperial’s investment into Auxly appears to have flown under the radar. Having Auxly on our radar early gives us an edge over every other investor on the market.

Thanks to Auxly’s commitment to dominating the cannabis derivatives industry, its established product pipeline, and Imperial Brands’ recent cash infusion — Auxly is in a position to emerge as a leading force in Canada’s phase two cannabis legalization.

And thanks to this summer’s decline in cannabis shares values, you have the opportunity to purchase shares for bargain prices just under a dollar!

Please keep in mind that this is an unofficial recommendation — not something we’ll track in the Altucher’s Investment Network portfolio. However, I wanted to share this investment with anyone interested in cannabis stocks trading at penny-stock prices.

Action to take: Buy shares of Auxly Cannabis Group (OTCBB: CBWTF) at market prices up to $0.85.