The Key to a Seven-Figure Pot Pension in the 21st Century

You can play the marijuana craze a million different ways — but I can’t wait to show you my favorite.

It’s a 100% fully legal program that could be your ticket to financial independence.

The best part about this alternative program is it works the same way a normal 401k fund does — maybe even better.

You just set it and forget it.

And your profits will grow automatically as the marijuana market takes off.

We like to think of it as a secret pot pension plan! But it’s even better than a 401k… A recent poll from Market Watch suggest 75% of Americans’ 401ks are vastly underfunded.

Most of us simply won’t have enough to cover our post-retirement living expenses using 401ks alone.

Enter “Weed-tirement.” This doesn’t involve risky penny stocks… or gambling on the next pot IPO…. or having to learn a complex trading system… or even going near Wall Street.

I’ll tell you everything you need to know to get started in a moment.

But first, allow me to set the stage on just how big the opportunity the marijuana market is becoming, especially considering where it’s been.

The Black Market

“Marijuana — weed from the devil’s garden. One moment of bliss — a lifetime of regret! Hunting a thrill, they inhaled a drag of concentrated sin!

Wake up America, here’s a roadside weed that’s fast becoming a national high-way!”

America’s changed its tune on marijuana since 1936. Modern politicians would be laughed off the podium for calling pot “weed from the devil’s garden.”

And yet, the effect of reefer madness was so strong, the U.S. took nearly a hundred years to pass bills like the Farm Bill (which made CBD oil legal)… Or allow states to determine their own marijuana laws — medical or recreational.

What reefer madness started, President Richard Nixon’s War on Drugs strengthened. With his 1969 declaration, he ushered in a new era of punitive drug management to rid the world of the insidious narcotics that were said to be ravaging the American people.

The agents, policies, and actions during the War on Drugs were brutal toward anyone involved in the drug trade — on both the distribution and consumption fronts.

What’s more, at the same time that fear-mongering campaigns were being waged against marijuana…

Ads for cigarettes reassured the American people that “more doctors smoke Camels than any other cigarette” and Lucky Strikes would help you “keep a slender figure.”

The Green Market

The following 80 years or so in American history has been a sort of delicate clutch shift… Easing up ever so slightly on trying to convince Americans that cigarettes were healthy, and pressing the breaks on peddling unproven claims that marijuana is a “deadly scourge” or “concentrated sin.” Now we’re in high gear.

In 2011, the Global Commission on Drug Policy released a report regarding the War on Drugs, stating that “the global war on drugs has failed, with devastating consequences for individuals and societies around the world.”

One reason why the War on Drugs failed is the same reason that Prohibition in the 1930s failed: Inebriation is part of human nature and society’s laws are not strong enough to prevent it. Canada has already legalized recreational marijuana — and their pot industry is a multi-billion dollar oligopoly.

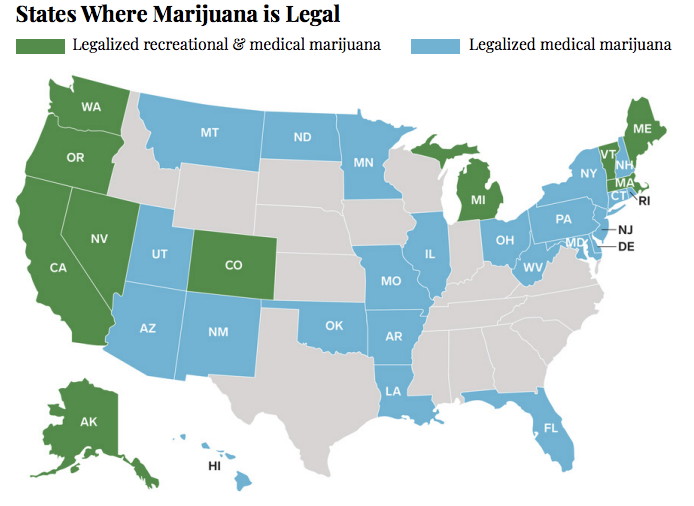

We literally saw articles in 2018 saying that Canada had run out of pot. Today, 33 states have legalized medicinal marijuana, 10 have legalized recreational marijuana, and 13 have decriminalized its use.

Thanks to these new laws and the abatement of marijuana’s association with derangement and degeneracy, 2018 was definitely the biggest year for marijuana investors of all time

We saw the 598% rise of CV Sciences, the 872% rise of Tilray when it went public, the 371% rise of MariMed…

And, as you can imagine, the rest of the “vice” industry is foaming at the mouth to be involved in a high-quality recreational revolution. Cigarette companies have been steadily losing money since the ‘60s.

No big surprise there. It’s hard to generate new customers now that everyone knows cigarettes cause cancer, COPD, emphysema, etc.

Classic beer companies are struggling to keep up with the demand for crossover products and craft brews. While the monarchs of the industry haven’t been dethroned yet, 40 of the top 50 breweries by volume are craft breweries.

But where cigarettes and other vice industries are struggling with their traditional methods, marijuana companies are stepping in. And we can certainly source patterns and nuggets of wisdom from these industries during their most productive periods. So far, marijuana’s ace-in-the-hole has been its medicinal properties.

And the medical value of marijuana is an even deeper well than we’ve realized…

The Mysterious 111

You probably already know about the two most well-known cannabinoids (compounds that are active in the marijuana plant): THC and CBD.

THC and CBD can both be found in marijuana, while only CBD is found in the hemp plant (what the Farm Bill made legal).

If you want to keep it simple, THC is the one that makes you goofy. CBD is the one that alleviates pain.

And the marijuana industry is saturated with products using those two cannabinoids. But here’s the exciting part…

So far, scientists have discovered 111 other cannabinoids that also have medicinal properties.

Leading scientists now believe that they can treat and mitigate issues like Parkinson’s disease, Huntington’s disease, Tourette’s syndrome, Alzheimer’s disease, epilepsy, multiple sclerosis, inflammation, bipolar disorder, schizophrenia, PTSD, depression, anxiety, and insomnia — just to name a few. But, here’s the catch…

When they’re found naturally, the quantities are too low to really have an impact. Just using weed wouldn’t have the same therapeutic effects these cannabinoids have because the most active cannabinoids in cannabis are THC and CBD.

If you were to isolate the other 111 cannabinoids, say, and increase their potency… That would be huge, right? Right out of a sci-fi novel! One notable company has found a way to isolate these cannabinoids and then grow them in YEAST.

Ginkgo Bioworks, the Boston-based biochemical organism wunderkind company, has developed custom-designed software that can build and imprint DNA sequences.

This technology can be used to grow yeast strains capable of facilitating large-scale cannabinoid production.

Ginkgo’s ability to grow, harvest, and concentrate cannabinoids that are too weak to use when naturally occurring will enable them to make a truly unique product. While the competition continues to play in the THC and CBD oil market, Ginkgo’s got the means to manufacture one-of-a-kind creations. If only there was a marijuana retailer willing to bet on them…

Finding the Needle in the Pot Stack

Cronos Holdings is doing things a little bit differently than its competitors.

There’s a reason its the best-performing marijuana stock in history. History has shown us that whenever there’s a big, new trend, the companies with staying power aren’t the ones with more of the product (although that’s definitely a factor). They’re the ones with better branding.

Think about the heyday of cigarette advertising — what happened to all the Chesterfields? The Benson & Hedges? The Viceroys and Lucky Strikes? Camel and Marlboro had way better advertising.

They stood the test of time. They stuck in the minds of the American people and stayed current through the ages. They diversified and vertically integrated.

The same will be true for all of these marijuana companies at the early stages of growth. Which is why Cronos Holdings has an interesting edge.

In addition to securing its own marijuana supply through partnerships — guaranteeing more than 250,000 pounds of marijuana grown annually — it has expanded internationally and scientifically. Cronos has linked up with MedMen, a U.S. based cannabis retailer, to launch its own dispensaries and tap into the U.S. market. But what’s the most significant partnership Cronos has locked in?

You guessed it: Ginkgo Bioworks.

So while all the other marijuana companies are focusing on the recreational properties of THC and the pain-mitigating properties of CBD…

Cronos Group can leverage its connection with Ginkgo to heighten the potency of these other medically valuable (and unknown) cannabinoids.

Eventually we’ll see beer infused with cannabinoids. Skin creams. Hot sauce. Bath bombs. Food stuffs.

Cronos Holdings itself is in the top five Canadian marijuana companies as far as market value goes. Now it’s got the strength of a unique product base behind them and an advantage in the medical community.

And we’re not the only ones who see value in Cronos…

Secure a Cannabis Cache Payday

U.S. companies are getting in on the game too.

Like Constellation Brands, the beer company behind Corona and Modelo.

It invested $4 BILLION into Canopy Growth, increasing its ownership to 37%.

From the date of Constellation’s announcement to its actual acquisition — the space of two months — Canopy Growth’s stock DOUBLED. Molson Coors Brewing Co. wanted in as well.

It purchased 57.5% of Canadian cannabis producer, The Hydropothecary Corp. Molson’s stock ALSO doubled in the space of two months. But the best gains in this industry are still on the horizon.

In fact, I’m about to tell you how to make sure you can play the marijuana mania — by isolating the most profitable company ever to enter the marijuana trade.

The No. 1 Vice Stock in America

You might not know Altria Group Inc. (NYSE: MO) by name, but you know what it owns: Philip Morris USA, Marlboro cigarettes, Parliaments, 9 ALTUCHER’S INVESTMENT NETWORK Copenhagen, and Skoal smokeless tobacco.

Essentially, Altria is mainly known as a tobacco powerhouse. And Altria also has its hands in the alcoholic beverages space. It owns Ste.

Michelle wines and has a stake in alcobev titan Anheuser-Busch InBev. But I’m most excited about the company’s strategic investments in e-cigarettes and marijuana.

The Crown Juul of the E-Cigs Movement

Electronic cigarettes have taken the world by storm.

They introduced “vaping” as a major cultural trend. Purported to be a healthier alternative to traditional cigarettes, e-cigarettes use electricity from a small battery to vaporize flavored liquid containing nicotine.

This gives users the same feeling as smoking, with fewer carcinogens.

In December 2018 Altria officially joined the e-cigarette business with its 35% acquisition of Juul, the industry leader with over 75% market share. With the $12.8 billion price tag, Juul is now valued at a whopping $38 billion.

To put that into perspective, Juul is now worth more than Ford Motor Company (NYSE: F), Kroger (NYSE: KR), and Twitter (NYSE: TWTR).

Juul is by far the most popular e-cigarette brand among millennials.

So Altria’s investment in Juul will help the company stay relevant as the traditional cigarette industry declines.

That covers Altria’s move into the e-cigarettes space. Now let’s move on to its strategic position in the marijuana market.

A Cunning Move into Cannabis

The traditional tobacco market is currently worth $108 billion.

While the e-cigarette market is expected to be worth $47 billion in the U.S. by 2025.

But neither of these markets hold a candle to the burgeoning marijuana market. Consider this: The pharmaceutical market in the U.S. currently sits at $450 billion.

That’s larger than the alcohol and tobacco industries combined.

When marijuana begins to replace top-selling drugs for pain management (think: opioids), companies across the marijuana value chain will begin to reap major financial gains.

And Altria is acutely aware of this, which is why it’s set itself up to take a piece of the pie. As of December 2018, Altria’s acquired 45% of Cronos Holdings for $1.8 billion.

Altria’s investment in Cronos Group is still early stages.

There’s not been enough time yet to put its $1.8 billion investment to work.

The marijuana industry’s CAGR is expected to grow 24.9%. Effectively, that means every $1 will turn into $3 over the next six years.

Should this hold true for Altria’s strategic investment that means that its $1.8 billion investment will turn into $5.4 billion.

Juul and Cronos have both been exceedingly successful in their respective spaces, but now that portions of each are under the same roof, there is an opportunity for some cross pollination. In the past few years, vaping marijuana has exploded.

Due to the convenience and health benefits, many traditional marijuana users have laid down their old school joints and blunts in favor of Space age-looking weed pens and vaporizers.

With Cronos’ expertise in marijuana and Juul’s trendsetting marketing team, Altria could reap major rewards from facilitating a Juul-branded marijuana vaping product. “Mad Money” host Jim Cramer agrees.

“If I had to choose between ‘[the] big tobacco titans, I’d pick Altira here… The company’s taking aggressive action to offset the secular decline in smoking,” Cramer says. And this investment in Cronos should allow the company to grow “in a brand new market that has a lot in common with the cigarette business.”

Indeed, Altria’s tobacco products are distributed to hundreds of thousands of points of sale around the world. A network that vast took them 100 years to develop.

This is not something that competitors can simply buy their way into.

The combination of Altria’s distribution network and resources with Cronos and Juul’s products, marketing, and IP undoubtedly offers investors far more than the sum of its parts.

Now that the dust has settled and the speculative fervor is over, this is a great time to take advantage of this long term growth while its stock is still trading without a premium. And that leads us to our investment opportunity…

The Secret Pension Plan Revealed

If at this point you’ve pulled out your smartphone and opened E-Trade, TD Ameritrade, or whatever trading platform you use, hold off on buying Altria stock.

I’ll explain. While I certainly think that Altria is a strong buy, there’s a more creative way you can invest in it to increase your profit potential.

I suggest treating the purchase of Altria stock as a long-term investment — with an eye toward retirement. It’s why I call this strategy the secret pot pension plan.

The reason is simple.

The e-cigarette and marijuana industries are in their infancy right now. But they will be massive.

I want your investment in Altria to grow alongside these industries — and ultimately serve as a nice nest egg. Imagine if you had the opportunity to invest in the alcobev industry in the 1930s right after Prohibition ended.

You would have made an absolute fortune. Marijuana and vaping are this generation’s opportunity to cash in at the ground floor. And better yet, Altria allows to invest in both in one fell swoop!

So, what is this secret pot pension plan exactly?

Slow-Cooker Investing

Never had a brokerage account before? There’s a way to invest in stocks without one.

This is a strategy you won’t hear your broker talking about… And you can’t do this with every company. Only certain companies offer this special investing plan.

It’s called a DSPP. DSPP means direct-stock-purchase-plan. Altria offers a DSPP option that enables individual investors to purchase a company’s stock directly from the company without the intervention of a broker.

Instead of a broker, you would purchase the shares through a transfer agent. In Altria’s case, the transfer agent is a well-known transfer company called Computershare.

Though there are fees to set up a DSPP account, they are generally lower than those of a traditional broker. In Altria’s case, there is a onetime $15 set up fee and a $0.03 fee per share purchased.

For Altria in particular, you only need to put up $50 to invest initially, and you can set up your transfer agent account to automatically extract a set dollar amount from your bank account at intervals you’ve set — just like your 401k. When you set up your DSPP, you get what’s called dollar-cost-averaging.

Basically, this means that because you’re investing an AMOUNT of money instead of a NUMBER of shares, even as the price of the stock fluctuates, the differences between your interval stock purchases even out over time.

Sometimes the stock is trading at a premium, sometimes it’s trading at lower than its value, and you reap the benefits by using the passive DSPP approach.

And to maximize your returns in the long term, be sure to select the DRIP option when setting up your investment. A DRIP is a Dividend Reinvestment Plan.

You don’t need to remind yourself every quarter to go into your account and purchase more shares — DRIP automatically reinvests your earnings.

This is very convenient given the long-term nature of the investment. DSPP investing is a great option for investors looking to set-it-and-forget-it, as well as avoid broker fees.

If you were to retire 25 years from now, reinvesting your dividends without using the DRIP plan would require you to make at least 100 distinct transactions to purchase the stock.

This would be time consuming — and costly if your broker doesn’t allow you to reinvest dividends for free. The other benefit is that with DRIP you can actually purchase fractions of shares.

Take the current price of Altria ($55.92) and the quarterly dividend per share ($0.80) for example.