Back when the computer was primarily a logic machine, silicon circuits dominated. With good reason…

Silicon switches work well at low power. That allows us to cram many-fold more switches onto a single chip compared to other switches that require greater force. So, with silicon we can do more logic in a smaller space and adhere to the prime directive of the computer age: Stay on the chip until the job is done.

And silicon can do this as long as we are not asking to manipulate anything more challenging than a symbol. A zero or a one digit “bit” weighs nothing in our minds; in the machine it weighs hardly more. To move a logic switch from on to off requires mere nano-watts of power.

But today’s computers are asked to do more than manipulate symbols.

Nowadays we increasingly require computers to act directly upon the physical world: to sense, see, hear, and smell the world — even to trigger physical events in the world.

The internet of things (IoT), the autonomous automobile, the growing complexity of the electrical grid itself — all demand computers to act directly upon the physical world. And most of these uses demand more switching speed, more power, and more durability than silicon can readily provide.

5G technology in particular will test the limitations of silicon.

Consider that the old- fashioned AM radio waves, for instance, operated at frequencies between roughly 500 and 1600 kHz, cycling between peak and trough some 500,000 to 1.6 million times per second.

That little FM “transistor radio” we carried around as teens operated at 88 to 108 megahertz (mega = million cycles per second). And 4G frequencies range between 700 MHz and 2300 mHz, 2.3 billion cycles per second.

“Today’s computers are asked to do more than manipulate symbols.”

Comparatively, 5G will use some parts of the 4G spectrum, down to 600 MHz and ranging up to 6 GHz (giga=billion). It then jumps up to the millimeter wave bands, 24-86 GHz, or roughly 50,000 times as fast as an AM radio.

Silicon isn’t well equipped to handle the frequencies or the power required at the high frequencies.

Indeed, we are now reaching the limits of what silicon can achieve out in the physical world.

That’s where this month’s recommendation comes in…

Step Right Up

So, what can replace silicon as technology continues to advance? The leading candidates to go where silicon cannot are silicon carbide (SiC) and gallium nitride (GaN), which are sometimes combined in the same device. That’s exactly why the leading integrated device manufacturer for both materials is our portfolio company of the month: Cree, Inc. (NASDAQ: CREE).

The company has been working in silicon carbide for 30 years. Two years ago, it acquired the gallium nitride assets of Infineon, then the industry leader.

In 2011, CREE produced the firstever commercial silicon carbide MOSFET (Metal Oxide Silicon Field Effect Transistor) — which in its silicon versions is the basic device of all semiconductor electronics.

Simply put, Cree is the Intel of silicon carbide. Admittedly, being the Intel of SiC hasn’t been nearly as sweet as being the Intel of silicon.

In all its 30 years, Cree revenues have never yet exceeded $1 billion. With 5G, IoT, and the need for electronic power control of larger electrical devices — including electric cars — we believe Cree’s time has come.

Before we get into what truly makes this a fantastic opportunity, it’s time for a science lesson…

Let’s Be Mad Scientists

How different are SiC and GaN from silicon?

Well first things first, both are a lot harder. On the Mohs hardness scale, a diamond rates 10. SiC is rated closely behind at 9.5, making it one of the hardest materials on earth.

Often called carborundum, before SiC was ever contemplated as a component in electronics, its most common use was as an industrial abrasive.

If you have ever cut stone with a circular saw, the blade was probably carborundum. It’s also used in bullet proof vests, and to make the ceramics used in car brakes and clutches. So, like I said, it’s hard.

Battles of the Band Gaps

What’s more interesting for electronics is that both silicon carbide and gallium nitride have wider quantum “band gaps” than silicon. The difference between a conductor, a semiconductor, and an insulator, can be thought of as the amount of electrical force that needs to be applied before each can be turned into a pathway along which electrons can flow.

Conductors will yield an electron flow at the drop of a hat, while insulators will hardly ever. Semiconductors are in between. Apply enough voltage to a semiconductor, and some of its electrons will jump the “band gap” from the valence band to the conduction band of an atom — and electrons will be available to flow.

Electrical conductivity is largely a function of band gap. Smaller bandgaps facilitate conductivity, while larger band gaps inhibit it.

This property of switching between conductor and insulator is what makes semiconductors the right material for an on-off switch sensitive to voltage thresholds. You couldn’t build one out of iron — the circuit would switch too readily. You couldn’t build one out of rubber, the switch would not go “on” at any realistic voltage.

“Conductors will yield an electron flow at the drop of a hat, while insulators will hardly ever.”

The question is, how sensitive do you want your semiconductor to be?

Silicon, with a relatively narrow bandgap of approximately 1.1 eV, can be made to conduct at relatively low voltages. That’s good if you are running a low power switch, which also usually means a lower frequency, slower switch. Silicon excels at “low and slow” the key to successful logic machines.

However, if you apply too much power, silicon works less well. At relatively low voltages, silicon experiences critical field breakdown and becomes a conductor.

Both SiC and GaN have a higher electrical field breakdown thresholds and greater maximum current density. This makes them more suitable for high-power uses.

Can’t Take the Heat? Get Out of the Semiconductor Kitchen

The heat that builds up in any electronic device just complicates the silicon challenge. That’s because heat reduces band gaps. Heat up a silicon circuit and it becomes a conductor at even lower voltages. With wide band gaps, SiC and GaN continue as semiconductors at much higher temperatures up to 400°C. That’s another advantage over silicon.

Yes, silicon’s melting point is more than 1,400°C. But it suffers sufficient thermal expansion at much lower temperatures to disrupt nanometer scale circuits. On the other hand, SiC suffers minimal distortion as temperature rises. It also has no known melting point; at approximately 2700 °C it turns into a gas, skipping the liquid phase entirely.

Not only does silicon not handle heat well, with low thermal conductivity it does a relatively poor job of getting rid of it. SiC has very high thermal conductivity, so it sheds heat easily. If SiC and silicon were kitchen implements, SiC would be a metal cooling rack and silicon would be a pizza stone.

“Up until the amplifier, all the processing of your original input — your voice, your fingers, your music, your video — has been performed at relatively low power.”

But here’s the thing…

It’s important to know that while SiC and GaN are superior to silicon in many ways, they are not perfect substitutes for each other.

GaN has much higher “electron mobility” and somewhat higher “electron saturation velocity” than SiC. Basically, that means GaN switches can run at an even higher frequency. But GaN’s thermal conductivity loses out to SiC, which makes SiC better at shedding heat. SiC handles high voltages and temperatures so well that one of its first uses in electrical management was as a lightning arrester in a high-voltage power system.

So, each has different advantages, which is why Cree makes both SiC and GaN-on-SiC devices. You can see this relationship in the graphic above showing the Band (energy) Gap, Electrical Field Breakdown Threshold, Thermal Conductivity, and Electron Velocity. On nearly every dimension silicon (yellow) comes up short, often way short, compared to SiC (blue) and GaN (green). Silicon’s only win, and slight one at that, is over GaN in thermal conductivity (the ability to shed heat), but using cool as a cucumber SiC as a substrate for GaN circuits compensates for that.

Shout It Out

You actually use technology every day where this combination of high power, high frequency and heat becomes critical — your cellphone.

Specifically, the power amplifier which is the last electronic device before the antenna.

Up until the amplifier, all the processing of your original input — your voice, your fingers, your music, your video — has been performed at relatively low power.

Now finally, at the amplifier, your phone has to shout. It has to power your signal from your tiny phone with its tiny battery up to a cell tower — which under existing 4G systems could be two miles away. This requires as much as five watts of power, more power than required by all the processing done by your phone before this point. 5G will require even more.

Today, most power amplifier chips are manufactured in LDMOS, a specialized silicon-based technology that overcomes some of silicon’s power limitations. LDMOS is challenging to manufacture which is why Cree — specializing in fabricating challenging materials — has an important business in LDMOS amplifiers.

But LDMOS is limited too.

Cree even advises its own customers that LDMOS loses efficiency at frequencies around 3 GHz — making more heat and less signal.

Cree has a solution…

It has developed a high frequency, high power solution for HPAs (high power amplifiers). Essentially, it combined the high switching speed of GaN with the durability and thermal conductivity of SiC, by laying GaN circuitry on a SiC substrate.

I know that’s all pretty technical, but here’s what you need to know: At 5G frequencies, GaN-on-SiC is more power efficient than LDMOS. And as we go higher up in the 5G bands, where we can transmit 100 times more information than a 4G network, the LDMOS loses even more ground.

Can You See Me Now?

Here’s something many people don’t know about 5G: It’s going to require a lot more base stations.

That’s because 4G base stations can receive and transmit as far as two miles, while high frequency 5G base stations will have ranges measured in hundreds of feet.

So, while today’s networks incorporate roughly 300,000 base stations in the US, full 5G will require millions — with most stations within a block of your phone.

This proliferation of base stations — embedded in traffic lights, perched on telephone poles or street lamps — will bring up considerations of size, heat, power management, durability, and even aesthetics far more challenging than for existing cell towers. Even under local pressure to appear inconspicuous, today’s cell towers are massive, spending cubic footage and weight to ramp up power and manage multiple signals. This minimizes interference across frequencies. Elbow room is a great help for managing all this power and potentially conflicting signals. 5G stations will have to do more — and do better — with much less space to work with.

Here, SiC becomes crucial. Because SiC devices, such as antennae, can use more power than silicon, a base station needs fewer of them — maybe half as many. That means a lot when you are talking about maybe dozens of antennae in a single box. Also, because SiC deals with heat so much better than silicon, it has less need of bulky support components such as fans and heat sinks. And with a high critical breakdown threshold, SiC and GaN-on-SiC devices can operate at high voltages without increasing the thickness of the insulating package, again saving on space.

Does a little space here or there really matter? You bet! Shrinking components is what made the first computer revolution possible. It is how your cell phone can pack more computing power than the largest computer on earth in the 1950s. Now just stare up at one of today’s cell towers and imagine sticking one of those on every stoplight or telephone pole. We won’t get to 5G or the great internet reboot, without a lot more shrinkage.

Let’s Get Physical

I started with SiC and GaN’s uses for 5G because they are a great example of the fundamental difference between the computer on a desk and a computer functioning in the physical world.

The purpose of a transistor is to control the flow of electrons; to use a small electrical force to direct a larger one. On the desk or laptop, the power control functions of a computer are limited to the power needed to drive the logic circuits themselves. Then there are other things to consider like the display and audio, but these are jobs that standard silicon switches can do well.

But in 5G and other applications in the physical world the computer requires orders of magnitude more power than what it needs to flip a logic circuit.

The need to amplify a radio signal is one example. But there are still larger forces that semiconductor circuitry must able to control, in factories, electric vehicles and the electric grid itself.

That’s where SiC, sometimes partnered with GaN, is the clear winner.

In any electrical system, “power control” is the job of making sure the right current at the right voltage gets to the right circuit — a non-trivial task across a large or complex system.

“4G base stations can receive and transmit as far as two miles, while high frequency 5G base stations will have ranges measured in hundreds of feet.”

On the electrical grid itself, the switches, converters, transformers, and more that do this job account for a disproportionate part of the total cost of the system. And every time power is switched from one form to another — voltages stepped up or down or AC converted into DC — some portion of the energy is wasted as heat.

The heat shed by these devices entails not only a huge loss of power but potentially the most dangerous and destructive events in the system. From the 1880s on — when electrical service first appeared — this work was done by electromechanical switches. The transistor raised the promise of greater precision and efficiency in the system. But early transistors were fragile and not widely used in power control applications for some time after they dominated computer logic.

Silicon’s fragility was one reason for the delay.

Electric Power Control Hits the Road

The most rapidly growing electric power control market is in electrical vehicles. If you are an EV skeptic, you have our sympathies. A tank of gasoline still packs much more power than a thousand pounds of batteries. Still, there is no denying that the progress in battery technology has made electrics much more attractive. And their numbers are likely to grow.

Your electric car’s battery is a DC device. Your electric car’s motor is an AC device. There are good reasons for this, but the combination is unfortunate. Every time your car has to convert DC to AC, energy is lost and heat is generated. So much heat, in fact, that the “inverter” units that do the job may require their own cooling systems. This adds weight, complexity, and cost which further drains power.

At various points, the electrical system in your car may be managing forces of 1200 volts. With silicon’s high resistance and a low breakdown voltage, the size and number of silicon components necessary to guide that force makes silicon solutions costly and complex compared to SiC.

At high voltages, silicon components can see energy loss at least twice as great as SiC components, undermining efficiency and generating heat. With its lower resistance, SiC creates far less heat than a silicon device. And because they endure heat better, SiC or GaN-on-Sic devices can ease design constraints — for instance allowing the devices to be placed closer to the engine.

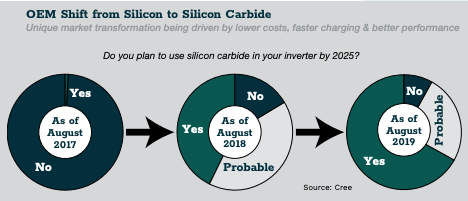

SiC inverters, which take high DC voltages and convert them into AC, can already be at least 70% smaller than silicon inverters. With similar reductions in size in other components, including in the onboard charger and battery management systems, SiC is enabling the integration of multiple systems on a single device, reducing complexity, cost, and energy-wasting interconnections. Just a few years ago, almost no car maker was using SiC for its inverters, which you can see in the exhibit to the left. Today, the vast majority say they have either switched to SiC or are planning to. But why did it take so long?

Trumping the Greatest Learning Curve in History

The simple answer is part of the reason for our enthusiasm for Cree!

You see, SiC, or GaN have not been widely used because they are hard to work with. But then so is silicon. It looks routine today only because with many billions of chips under their belts, the great silicon chip makers have benefited from the greatest learning curve in all history.

First formulated by Bain and Company, the learning curve predicts a 20-30% reduction in cost for every accumulated doubling in units sold. The famous Moore’s Law is really just a special case of the learning curve. Chip prices dropped so fast because doublings in accumulated volume kept coming so fast.

During this entire period, while silicon was soaring up the learning curve, SiC production was limited to a relatively few companies, none the size of a major silicon producer. No SiC product was ever produced in a fraction of the volume of a silicon MOSFET, the device that has dominated semiconductor logic since the 1960s. SiC’s learning curve was all too gentle.

The first commercial SiC MOSFET was released by Cree almost 50 years after the commercialization of the silicon MOSFET. On the learning curve, SiC has a lot of room to run. As production ramps up for 5G and electric vehicles expect dramatic decreases in cost and increased in capability.

Cree Goes All In

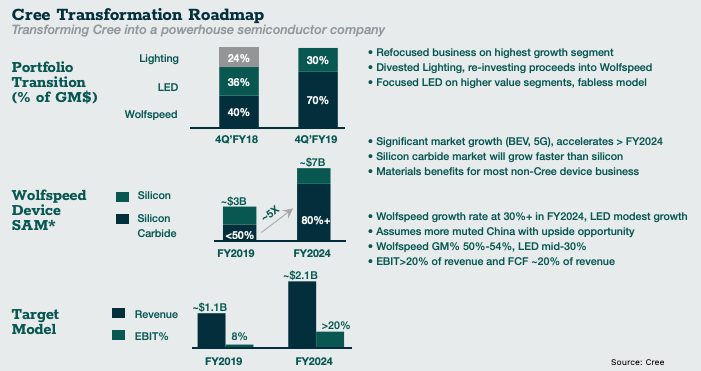

For many years, CREE operated three divisions: a general lighting division, an LED division and the RF and power control division (now known as Wolfspeed).

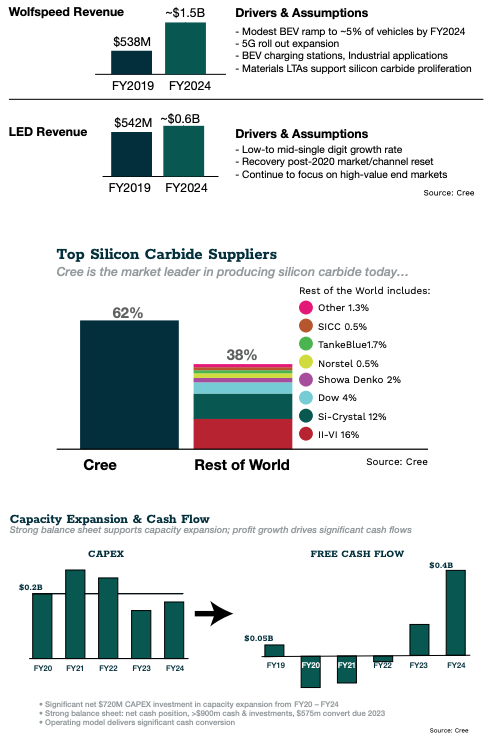

It sold the lighting division in 2018 to focus on the higher margin LED and RF and power opportunities. Until last year, LEDs still brought in more revenue. But Cree is staking its future on Wolfspeed, which has tripled its revenue over the last three years. Over the next four years Cree expects more than 90% of revenue growth to come from Wolfspeed.

To that end, Cree is pouring $1 billion into a program to increase its silicon carbide wafer fabrication capacity by 30-fold by 2024 — and increase its production of raw SiC and GaN materials by similar amounts.

CREE is staking its future on SiC and SiC-on GaN pushing silicon aside as the computer becomes one with the world.

The Alpha Leads the Pack

Cree may be all in on SiC and GaN, but it has competitors in both. These include some of major chip makers, whose interest is growing. Corning looms large. Even Cree’s competitors, however, speak of the company as the “traditional leader” in the field. Cree’s accumulated expertise in SiC fabrication means that many of its competitors are also customers. That’s because Cree is a leading producer of not only SiC wafers, but of SiC crystals. (Silicon carbide is very rare in nature and must be manufactured.

Wolfspeed Joins the Party

The making of silicon microchips is a big-company business today. Cree would have to fight hard for the SiC market if the industry’s giants decided to focus on it. On the other hand, for many of the major firms the obvious first step to win the SiC market would be to acquire Cree. Cree starts out with the greatest mastery of the material and the best and biggest fabs, soon to be much bigger and better.

How likely is that? In 2015, Cree spun off its RF and power electronics business into a subsidiary called Wolfspeed, potentially easing a spin-out of the unit. Two years later, Cree rival Infineon made a bid for Wolfspeed. Cree accepted, but the deal was blocked by regulators.

A year later, Cree reversed direction and bought Infineon’s RF and power electronic assets including the facilities to produce GaN devices. Cree was now not just the SiC company but the GaN on SiC company, significantly strengthening its 5G product line.

So, let’s recap that:

- Wolfspeed was for sale just two years ago.

- SiC and GaN are more relevant than ever.

- Just two years ago, an aggressive major wanting to acquire SiC and GaN capacity would have had to buy BOTH Cree and Infineon, now it ONLY has to buy Cree.

Hmm….

We Want In! Let’s Buy Cree

Is the stock a buy? We think that’s a definite yes, and not just because of a potential takeover — though that would be sweet!

Cree’s stock has been volatile over the years. It seems to have been viewed alternately by investors as a solid — but niche — manufacturer or the “next big thing.” During the next big thing periods, the stock soared. Then as Cree quietly resumed growing its niche businesses, the stock consolidated into a long slow upward trend.

With the convergence of 5G, electric vehicles, IoT, and a growing consensus that America’s power grid needs a generational upgrade — we think the stock finally deserves “next big thing” status. We view its billion-dollar investment to meet a projected a 30- fold increase in demand, as an investment in learning curve effects that are likely to enrich the company and its stockholders for years to come.

OK, we must do our due diligence and also look at price risk and reward.

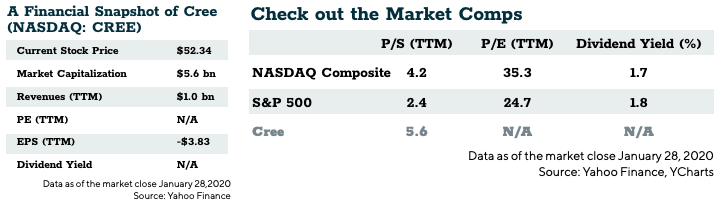

On price, PE doesn’t help at the moment as the company is not profitable.

So, let’s look at price to sales which right now is 5.6X. That’s not unreasonable for a hot, high-tech growth company. The price to sales ratio for the NASDAQ composite is not much lower at 4.2.

The risk? We aren’t very worried about Cree’s ability to execute or maintain its edge in mastery of the process. Clearly neither are its competitors or they wouldn’t be buying so many of Cree’s wafers.

And we are not really worried about competition from a major because we actually see a takeover by a competitor as the quickest way to close this trade profitably. The majors getting into the game would be a feature not a bug.

The real risk is that the growth in the SiC/GaN market might be less or slower than expected.

We aren’t worried about 5G. We think it will come at least as fast as reasonable people expect. But 5G alone can’t fully power Cree’s growth prospects. Much of that 30-fold increase in SiC demand for which Cree us gearing up is predicted to come from increased sales of electric vehicles.

Electrics could grow slower than predicted which is the biggest risk we see. And we don’t think it’s very big. The political and even social pressure to go electric is getting stronger, not weaker.

And even for those of us who do not find it easy to be green there is another factor. Electrical cars are flat out cool.

As for rewards, with every significant increase in revenue Cree’s rep as a hot company will be confirmed, likely maintaining that 5X multiple on sales and maybe stretching it out.

If Cree revenues double over the next few years — which does not seem unlikely — the stock should do at least that well.

This is a long-term investment that we can expect to have in our portfolio for a while to truly realize its full potential.