Social Security is currently 83 years old.

Knowing this, you may want to sit down for what I’m going to say next…

Per the Trustees of Social Security Trust Funds, Social Security will become insolvent by its 99th birthday.

That’s right. FDR’s haloed brainchild — bastion for the elderly and white knight for retirees — will no longer be able to pay its citizens what they are owed.

Despite the constant debates between Congress, the president, various committees, and political watchdog forces…

No viable solution has been reached to increase Social Security’s meager, and ever-dwindling, supply of capital.

That said, all hope is not lost.

Interestingly enough, our neighbors to the north have got it all figured out…

Indeed, Canada is successfully taking care of their 20 million retired seniors — and they’re leading by example. Consider the following:

- According to the United States Economic Cooperation & Development, Canada has much lower debt than the U.S.

- The United Nations Development Index shows that Canada ranks ahead of the U.S. — and ranks No. 12 globally — in terms of life expectancy, education, and income.

- Canada was recently ranked the second best and most stable country in the world to live in, right behind Switzerland.

Clearly there is a lot we can learn from Canada. Especially because they have one of the best incarnations of social security in the free world right now.

We’ll dig deeper into their social security plan in this report. But for now, just know that the Canada Pension Plan (CPP), their major public retirement fund, manages C$392 billion in stock assets by itself…

And recently, three of Canada’s regional pension funds, worth a combined C$441.1 billion, have started thinking in green. That is, they’re now making pension investments in the marijuana space.

So their already-powerful pension plans are generating more income than ever before.

I’m going to show you how to use their plan to your advantage… and save yourself from going down with the Social Security Administration ship.

But first, it’s important to understand that Canada wasn’t always so successful.

Knowing their history, and how they dug themselves out of their deficit, will help you decide on your next step as an investor…

Turning to the Private Sector in Times of Crisis

Back in 1965, Canada launched the Canada Pension Plan.

And just like U.S. Social Security, it was funded mostly by citizens’ hard-earned wages and the government siphoning a large portion 4 ALTUCHER’S INVESTMENT NETWORK through taxes.

Fast forward 31 years, and their “system” was on the brink of collapse.

It couldn’t keep up with Canada’s aging population, increased life expectancy, changing economy, and benefit improvements.

A recent study by the Canada Pension Plan’s chief actuary showed that the entire infrastructure could’ve gone bankrupt by 2015.

A bit like our own Social Security situation…

However, Canada actually spent the time, manpower, and capital to fix the problem.

They sourced Canadian public opinion, consulted some of the best financial experts in the world, and collaborated with the board of their pension program.

In 1997, they established the Canada Pension Plan Investment Board (CPPIB).

And here’s how it’s different than American Social Security.

The American Social Security trust funds are exclusively “invested” in a type of treasury bond that can only be issued and redeemed by the Social Security Administration (SSA). These special-issue bonds are not market-based — their growth and movements can’t be tracked using common market indicators, like the Dow Jones or the S&P 500.

Now, unlike American Social Security, the CPPIB have federal provincial ministers who invest the CPP’s funds in the public and private sectors, buying up massive quantities of low-risk, high-value stocks. In other words, our government bets on itself, borrows money from itself, writes itself an IOU, and plans to pay itself back with future tax receipts.

In Canada, citizens pay into the CPP… the CPP grants the CPPIB access to its funds… the CPPIB invests in Canadian companies… And the positive results reverberate throughout Canadian society. But their momentum didn’t stop there.

Canada: The “Choose Yourself” of Social Security Plans.

In 2000, under the Public Sector Pension Plans Act, several new investment groups were created to manage pension funds.

And in 2017, the Canadian government set up a plan to increase the income of their senior citizens by a minimum of 14% and even at the maximum, an unheard of 50%, depending on your pension investment allocation.

The plan involved creating new regional and municipal pension funds and spreading the controllable assets from the CPPIB among them.

All of these pension funds, considered “Crown corporations,” (meaning owned by the federal or provincial government) manage a variety of assets for many purposes.

Currently, the top 10 pension funds in Canada have a collective asset value of more than C$1 trillion. And with such a great responsibility to its people, Canadian pension funds are careful.

Bloomberg refers to these fund managers as “traditionally riskaverse investors.”

So when they make big moves, we can rest assured that they’ve done their research.

It’s also a clear sign that the industry is ready for retail investors.

It’s not a “risky,” untested sector that’s only for speculative investors.

As John Downs, director of business development for U.S.-based cannabis investment firm Arcview Group, says: “When you think of someone managing their retirement money who is normally risk-averse now getting into cannabis, the perception of risk in this sector is likely to change.”

Which leads us to Canada’s latest move — one that’s giving them a huge advantage over the rest of North America.

America Turns Green with Envy Everyone knows

Canada just federally legalized medicinal and recreational marijuana.

Marijuana’s legalization made lots of early investors very wealthy, and introduced several key cannabis players to the scene.

And “marijuana assets,” especially the Canadian behemoths dominating the market, are rising exponentially.

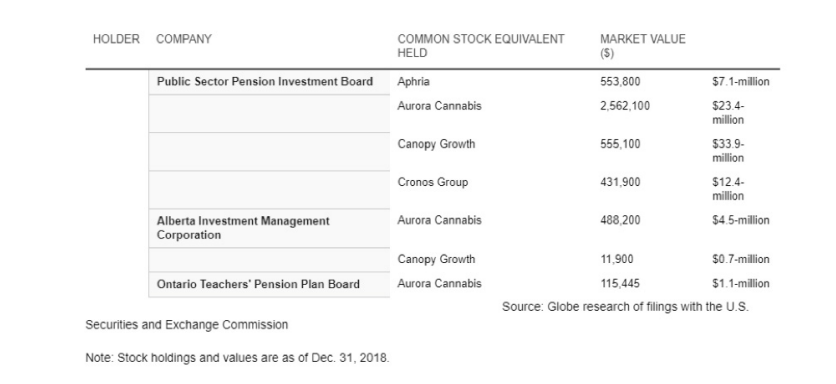

That’s why, as I mentioned before, three of their municipal pension funds greenlit heavy investments into four heavy-hitting marijuana retailers.

The funds are the Ontario Teachers Pension Plan, Alberta Investment Management Corp., and the Public Sector Pension Investment Board. Of course, this is great news for the Canadian public.

But a few Americans are now able to benefit, too — allowing them to collect as much as $1,504 to $6,112 per month in income!

And you can join them starting today.

If you were required to thrive on investments from one sector, what elements would it have?

I would want it to:

• Already have an enormous total addressable market (TAM.)

• Have a projected sales income of more than C$7 billion this year alone.

• Have made millionaires of its early investors.

• Have partnerships and contractually obligated returns with some of the biggest Fortune 500 companies to ever exist.

• Be expected to overtake the value of the entire hard liquor market of a country in a short two-year period.

• Be backed by the strongest retirement program in the world…

The marijuana industry boasts all of these benefits and more, making now the time to invest, before everyone else catches on.

That’s why those three pension funds, managing a combined $441 billion in assets, put their carefully-guarded money on pot.

The Three Wise Men of Weed

More specifically, they trusted the four most powerful Canadian marijuana companies to grow their money.

They revealed their investment in December 2018.

Since then, three of these companies’ stock prices doubled in two months.

The fourth shot up 67%. And those pension funds are feeling pretty satisfied with their decision.

These four companies in particular brought in $238.47 million in revenue in 2018 — and recreational pot wasn’t even legal for nine months of that year.

Just imagine the authority they’ll wield with a full year to put their respective strategies in place…

And even though we can’t take advantage of the Canadian Pension Plan directly…

We can certainly reap what they’ve sown.

How? By investing alongside them and pocketing the gains when the stocks explode higher.

Pot Pension Play#1

Aurora Cannabis (NYSE: ACB), the licensed cannabis producer headquartered in Edmonton, has just released its third quarter earnings — and they are impressive to say the least.

At the beginning of the year, management anticipated first-quarter fiscal 2019 revenue to land in the neighborhood of $50-55 million.

The company only generated $11.7 million in revenue just a year earlier.

And… it happened. Aurora’s revenue landed right at $54.2 million. Making a bold prediction in an ever-changing market is one thing.

Nailing that prediction inspires major confidence. Aurora is drawing from three segments.

First, the company’s international shipments remain stable as its base of medical marijuana continues to grow, now totaling 77,000 patients in Canada.

Second, it has managed to bring its sales in the European Union (worth about $98 billion) from $2.9 million to $4 million in a single quarter. Not to mention, Aurora has operations in 18 countries.

And third, its production is continually increasing — thanks largely to the expansion of its Aurora Sun facility. Aurora has upped the ante by announcing that its largest facility will now be expanding to 1.62 million square feet, able to produce more than 500,000 pounds of marijuana annually. Taking into account Nelson Peltz, Aurora’s new strategic advisor and food industry veteran, as well as its purchase of Mexican pharmaceutical manufacturer and distributor Farmacias Magistrales, it’s no wonder all three pension funds added Aurora to their portfolios.

Recommendation: Buy ACB on dips to $7.50.

Pot Pension Play #2

Aphria (NYSE: APHA) is an Ontario-based healthcare marijuana company.

It may seem like a strange pick — since its stock has only moved laterally in the last year, and its sales lagged in 2018 compared to the reigning marijuana moguls.

However, it’s my belief that the issues hampering its growth are only temporary, and that because Aphria’s found viable solutions to its problems, now is the time to buy.

It has facilitated powerful supply agreements with every Canadian province, and partnered with the largest wine and spirits distributor in North America, Southern Glazer’s. The company agreed to distribute Aphria’s products throughout Canada. Aphria’s grow facility, Aphria One, is now licensed. Its estimated production rate is more than 500,000 pounds of marijuana a year. That makes it a major contender in the Canadian marijuana game.

Additionally, Aphria has licensed operations in more than 10 countries.

In Germany, it’s one of only three marijuana companies licensed to grow medical cannabis. Considering its production value, strategic partnerships, and international reach — along with its low valuation as compared with its industry peers — I think we’re looking at a very appealing potential partner for other companies looking to enter the marijuana space. I can see why the Public Sector Pension Investment Board chose to back Aphria, and I think we should too.

Recommendation: Buy APHA on dips to $5.

Pot Pension Play #3

Cronos Group (NASDAQ: CRON), the cannabis research, production, and tech company, has an interesting edge. It ranks third in terms of pot stock market caps, and Altria’s recent $1.8 billion investment in Cronos has added more juice to an already lucrative enterprise. In addition to securing its own marijuana supply through partnerships — guaranteeing more than 250,000 pounds of marijuana grown annually — it has expanded internationally and scientifically.

Cronos has linked up with MedMen, a U.S. based cannabis retailer, to launch its own dispensaries and tap into the U.S. market. The company also has operations in Israel, Australia, Germany, and Poland. Its most significant partnership is with Ginkgo Bioworks, a biotech wunderkind out of Boston.

Cronos Group can leverage its connection with Ginkgo to heighten the potency of medically valuable (and unknown) cannabinoids, something no other prominent weed company is doing. Cronos itself is in the top five Canadian marijuana companies by market cap. Now it’s got the strength of a unique product base behind them and an advantage in the medical community.

Anyone paying attention to the marijuana market would be markedly remiss not to have Cronos in their portfolio.

Recommendation: Buy on dips to $12.

Pot Pension Play #4

If you’ve been paying attention to the dawn of the pot powerhouses, there’s no way that Canopy Growth Corporation (NYSE: CGC) has escaped your attention.

Based in Ontario, Canopy is the world’s largest cannabis company by market cap. It is also the company that Constellation Brands Inc., the largest beer import company in the world, chose to invest in (to the tune of C$4 billion, no less). Canopy is constantly innovating and advancing.

Just this past April, it announced that it’ll be acquiring the U.S. multistate cannabis operator, Acreage Holdings, as soon as “cannabis production and sale become federally legal in the United States,” per Canopy’s rep. Bruce Linton, co-CEO of Canopy Growth, says that Canopy will be a one-stop shop for production, scientific expansion, infusion, extraction, and medical facilitation. It already has a total of 4.3 million square feet of licensed growing space, with plans to add more.

And while the company hasn’t released its earnings from the first quarter of 2019, some of its competitors — Aurora, Cronos, and Tilray (a relative outlier) — released stats reflecting sales growth of 21% and revenue growth of 15% and 48% respectively.

The company’s success can only bode well for Canopy’s vice grip on the marijuana industry. It belongs in every marijuana investor’s portfolio — it’s the closest thing to a blue-chip stock this burgeoning industry’s got! Recommendation: Buy on dips to $37.

Recommendation: Buy on dips to $37