Income alternatives in a volatile market

Just in time for Halloween, negative interest rates have spooked the mainstream media.

When a central bank initiates negative interest rates, lenders need to PAY borrowers for the right to lend money.

Already, the EU and Japan have cut interest rates into the negative. And here in the U.S., President Trump has also floated the idea (loudly and on Twitter).

For investors, here’s the important takeaway: Negative interest rates don’t care about your income needs.

Think about it… who wants to PAY someone else to hold their money?

It’s bad enough having to sometimes pay fees to use your own money, but with the threat of negative interest rates (and the reality of an inverted yield curve), earning money on your money just became more difficult.

Of course, you can still buy stocks for capital appreciation. That remains central to our strategy for wealth creation here at Altucher’s Investment Network. But amid growing volatility, it comes with some risk.

As such, practically every diversification model on the planet tells us that some income alternatives need to be considered.

That’s why this month, I’d like to present you with an opportunity to generate passive income despite a volatile market…

Health Care-Based Income

Let me tell you a little secret: As a population, we are getting older.

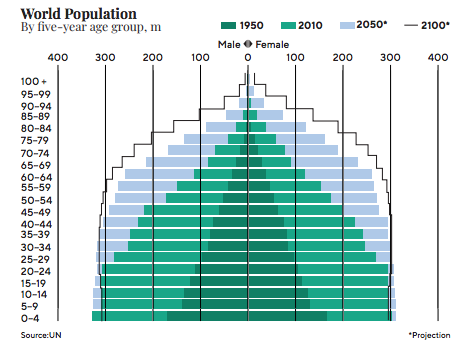

The chart below shows world population by age group, age zero to over 100. As you can see, the world’s population is projected to skew much, much older in the decades to come.

What’s most notable here — and something we can potentially profit from — is the expected doubling of ages 80 and higher, including 100- plus years old. It only makes sense. Thanks to advances in medicine, improved sanitation, and access to better food, we’re living longer.

As such, more and more older individuals will require living assistance. This is where today’s income idea comes in… a company that will not only serve the needs of an aging population, but also fill our income void in the current low rate environment.

It only makes sense. Thanks to advances in medicine, improved sanitation, and access to better food, we’re living longer. As such, more and more older individuals will require living assistance.

This is where today’s income idea comes in… a company that will not only serve the needs of an aging population, but also fill our income void in the current low rate environment.

Omega Healthcare Investors (NYSE: OHI) is a real estate investment trust (REIT) focused on the health care industry. The company owns triple net lease skilled nurse and assisted living facilities that it leases out to operations that actually run the business of caregiving.

OHI owns a lot of properties and investments in the health care space — roughly $8 billion worth. In fact, during the second quarter of 2019, OHI completed a $623 million merger with MedEquities, and in the third quarter it plans another $735 million in new investments.

Although big-ticket investments like these dilute shareholders in the near term, it is double good news for us.

First, the dilution depresses prices, so we can buy the stock cheaper. Second, the additional properties should help increase the company’s net income, funds from operations, and funds available for distribution moving forward.

It’s that last one, funds available for distribution, that interests us most…

Generating Passive Income From the Power of Dividends

As a REIT, OHI receives special tax benefits if it pays out most of its funds available for distribution in the form of a dividend — or, as we are viewing it, income.

In its most recent quarter, OHI had $150.6 million, or $0.68 per share, as funds available for distribution. It subsequently paid out a dividend of $0.66 per share, or 97% of the amount.

And it pays a dividend similar to this every single quarter.

Currently, the stock yields a little bit above 6%. Try finding that in a CD at your local bank.

This is dividend growth investing at its finest — a strategy we’ve discussed and utilized in previous issues of Altucher’s Investment Network.

In the case of OHI, which pays a 6% dividend, when you buy $1,000 of its stock you’re entitled to a $60 check from the company annually.

If you then direct your stockbroker to reinvest that $60 back into the company, you’re entitled to a compounded return. When it comes time for the company to pay out another 6% dividend, you’ll be paid 6% on $1,060 — instead of the original $1,000 you spent.

The money you invested into OHI, a dividend-paying company, earned you a return. And then, OHI will pay you an even larger dividend based on the money it already sent you and that you reinvested back into the company.

That’s the power of compounding. Your money is working for you.

A Well-Rounded Investment Thesis

With any investment, it’s important to understand any risks involved. And OHI isn’t without its challenges.

First, the company will seek to continue to acquire properties, which means it will raise capital from time to time. That has the potential to weigh on the share price of the company. Generally, it is a short-term phenomenon and a good time to buy additional shares, but some investors will panic and sell their holdings. Don’t be those people!

Second, the Texas Legislature failed to pass any form of skilled nursing Medicaid rate relief. (Are you shocked to see politicians not doing their job? Yeah, neither am I.)

Meaning state operators in Texas will still receive one of the lowest Medicaid reimbursement rates in the country — negatively impacting OHI’s Texas facilities in terms of funds available for distribution.

The good news is the dip in Texas should be offset by the new Medicare reimbursement model, PDPM (Patient-Driven Payment Model), that began this month. It calls for a 2.4% reimbursement rate increase nationwide.

The hard truth is we’re all going to get older. As we reach our golden years, we may require a little help. But until we get there, OHI can assist us by providing some income along the way.