Oops! Been spending too much time in the pits and crypts of the COSM. Daily tasks slip from memory.

Case in point, I forgot to renew my driver’s license and it expires tomorrow. When I realized this it was already 4:30, and the DMV closes at 5:00.

But I refused to miss the renewal deadline. Because to re-apply I’d have to take the written test all over again which would be a disaster — because who even remembers half that stuff?

All a twitter, I hop into my car and speed (gently) into town, making it with five minutes to spare. Yay! No written test! But there’s one thing you can’t escape. The eye test!

It seems the venerable city fathers absolutely positively insist that to drive you must be able to see!

Picky, picky.

I consider telling the old guys that, in the great halls of silicon science, this once fundamental requirement — that drivers be able to see the road before them — is now regarded as old-fashioned, obstructionist, excessively costly, and distinctly retro.

All the leading autonomous car contenders say we should be quite content for our cars to see through a glass darkly. They have decided that with enough silicon and software, programing and processing power, plus a super-fast 5G connection to the network (I made it all the way to Pittsfield, and I wasn’t networked to anything!), your car’s vision can be pretty dim without dooming you to excess contact with your airbags. (But please don’t turn them off. You never know when that network might fade out!)

“All the leading autonomous car contenders say we should be quite content for our cars to see through a glass darkly.”

How did we get to this vision of nearly visionless, all software and processor driving? I hate to say it, but at the root my beloved silicon is to blame.

Silicon is the very substance of the digital world — beautiful, perfectly crystalline silicon. But like all great beauties – silicon is also a temptress.

Silicon Sin: It’ll Make You Go Blind

The temptation has always been this: Moore’s law promises us virtually unlimited digital logic at lower and lower cost. More, cheaper circuits let us run bigger, faster, more ambitious software. So powerful that we might not only master the universe but make our own. It’s silicon’s original sin.

Silicon makes uniquely powerful logic machines for processing the data of the world. But as Eve believed that by eating the apple she would become a god and know the world from inside out — the silicon seductress hisses that the power of silicon logic to process the data of the world is so great that we can skip past one small insignificant problem…

Silicon, on its own, cannot touch the world, cannot see the world, hear the world, taste, smell, or sense the world.

The world itself is not made of logic. To get the world into the machine, to capture its sensuality in the silicon, we always need an analog gateway, and usually it will not be made of silicon.

The thing is, what makes the temptation all the more real is that it can almost be done. After all, I am the author of the book, The Silicon Eye. It’s perhaps my favorite. A grand romantic tragic story of Misha Mahowald’s attempt to create an analog eye on silicon film, based on the differential penetration of colors of light in silicon.

Google the term silicon sensors” and you will garner thousands of responses. But these are all “silicon-based” sensors, nearly all of which integrate other substances and require exotic manufacturing processes to produce a chip with sensory powers. Most leading-edge sensors cannot be produced using the classic silicon process (CMOS) that gave us Moore’s Law and the sub-micron miracles of digital logic that sees every challenge in terms of the brute force of massive logical processing.

Precisely because we can process so much data, so fast, and so cheaply, the seducer is always inviting us to accept inferior sensory data and then compensate with what silicon does better than any substance on earth. Combined with ingenious software — artificial intelligence — it processes the inferior signal so fast that it almost makes up for all silicon shortcomings. Most of the time. We saw one such effort recently at Boeing in the 737 Max.

“Silicon, on its own, cannot touch the world, cannot see the world, hear the world, taste, smell, or sense the world.”

This is the route most current autonomous car ventures are following. Google’s Waymo, Elon Musk’s Tesla, Levandowsky’s previous Uber scheme, and the host of imitator “autonomy” projects, all start from the same place. First, they start with offthe-shelf hardware — existing lidar, radar, and camera systems. (Yet none of those are capable of seeing the world well enough to guide an automobile moving at 88 feet per second — or 60 mph.) Then they attempt to enhance the signal with artificial intelligence, big data, mapping, and software.

But there’s one crucial limitation…

Vision Impaired Automobiles

That crucial limitation is the lidar systems used by most of the current contenders. Lidar (Light Detection and Ranging) is essentially optical radar, using much higher frequencies than conventional radar. So it can approximate human vision. Most Lidar systems operate on a wavelength of light — 905 nanometers — that is close to the visible spectrum.

Unfortunately, the 905 nanometer near-infrared band also can affect human eyes. That means the power must be turned down to avoid blinding other drivers. This limits conventional lidar range to less than 200 feet.

The solution to this so far has been to accept the nearsighted signal, multiply the number of lasers in the “paint can on the roof, pile on software and processing, and use AI to guesstimate what’s really out there.

But here’s what’s most unnerving of all… If you scan through the industry literature, you will see ominous phrases like “the autonomous car market will be a huge boost for 5G suppliers.” Why? Why does a car need gigabit scale network speeds to become autonomous? What’s so autonomous about that?

The answer is that the vision systems most of these ventures contemplate are simply not good enough for autonomy. The 5G connection is needed to compensate for the cataracts in the can. In other words, our near-sighted “autonomous” car is going to need lots of other hints about what is going on around it.

In order to make an upcoming turn, it will need a 5G connection to the cars on either side of the lane, a 5G connection hooked into traffic crossings to warn of old ladies unaccompanied by boy scouts (gender neutral, we promise!), and a 5G connection to Google Maps (which will get really, really better, we promise!).

Possibly it could all work, especially in cities purpose-built for cars without drivers, with transceivers embedded in every foot of asphalt and curb — along with the stop signs and street signs, traffic lights, and who knows what else… You’d essentially be turning the city streets into a sort of electronic bumper car arena.

They are planning to do it in China. And by the time they are done with their autonomous city, it wouldn’t be an automobile system anymore. It would be a railroad.

Austin Russell Shakes Things Up

Threatening to vaporize this mess with his X-ray vision is one Austin Russell, a 2013 Thiel Fellow, whose first venture into entrepreneurship was spurred at age 12 when his parents denied him a mobile phone. He responded by building one from the guts of his portable Nintendo. Today Russell heads up Luminar, a still-private company aimed at turning the race for autonomous cars inside out.

Russell’s insight is that that no amount of big data can make up for bad data from hopelessly inadequate vision systems. His solution is for an utterly reliable real-time image and interpretation of the road ahead for at least 200 meters, even in the dark. The system can see objects that are reflecting only 5% of the light that strikes them. Two hundred meters gives a car seven seconds to react, compared with the 1-2 seconds afforded by existing systems.

By attempting to make driverless cars from pre-existing, inadequate, hardware, most current entrants fall on the wrong side of Clayton Christensen’s model of “integration vs modularity.” When a product fundamentally underperforms the market’s requirements, integration is essential. You can’t just go down to Fry’s and cobble together existing devices. Every component and interface must be optimized for maximum system performance

Russell forged a different path.

In 2012, when he was 18 years old, Austin Russell resolved to start from scratch and build entirely new integrated systems with at least 50-fold more resolution and tenfold more range than the prevailing standard.

He knew that his system would seem like an implausibly expensive pipe-dream that would never see production. But there is no long-run demand for a system that kills people. Aim at low cost first and you will not achieve sufficient performance to have an enduring business. Aim for performance, what Thiel would call zero-to-one innovation, and low cost will follow. Demand will foster economies of scale and learning curves that bring the price down over time.

Integrating Analog Vision with Digital Logic (Kind of Like Your Brain)

Russell’s first crucial decision was to abandon the 905 nanometer nearinfrared standard used by most Lidar. By moving deeper into the infrared band to 1,550 nanometers, already employed in fiber optics, he could ramp up the power of the laser 60-fold without endangering human beings. This higher power extended the Lidar’s range out to 200 yards.

Rather than separating the vision systems from the interpretive processing, Luminar integrated them, as human vision systems do. It threw out silicon. Instead, it adopted an exotic, high-performance alloy — indium gallium arsenide — for its chips.

In essence, Luminar produced a microchip “eye” coupling the analog sensor that scans the road thousands of times a second with the digital processing to interpret the data. This is how human vision works: neither the retina nor the brain sees anything alone; only the integration results in vision. It’s only vision when an excellent image is combined with powerful processing, virtually instantaneously. Either shortchange or slowdown the hardware or the software, and you get up close and personal with a whole lot of telephone poles.

The Moral of the Luminar’s Story

You can’t buy Luminar stock yet. (If it does an IPO we will be shouting it from the rooftops!)

So why I am I teasing you with Luminar? Because the Luminar story illustrates a powerful point and an enormous opportunity, not only in autonomous cars, but in the internet of things (IoT), artificial intelligence (AI), and 5G networks.

Each of these faces the same challenge: to function they need a seamless connection between the physical world and the logical world, between state-of-the-art analog sensors and faster-than-ever digital processors.

And from the beginning of the computer age, the way to go faster and better and stronger, to defeat the challenges of latency and heat which always occur at the connections between devices — has been to get the entire computational device onto a single chip.

For chips that do only logical processing — not sensing the physical world — the answer to that challenge has always come from the wonderful crystalline purity of silicon, which in turn gave us Moore’s law, doubling processing power on a chip approximately every two years. These advances represent astonishing feats of engineering.

But as tough as building a pure logic (or memory) chip has always been, combining sensing circuits with logic circuits has always been even tougher, even more expensive, and often even more profitable.

And even more important.

If we really want computers that can interact with the world, it’s even more important to get the entire sensing/processing device onto one chip. Light travels at 186,000 miles per second. So the time it takes for an electron to traverse a single circuit is trivial. But when you multiply that to miles of connections — your laptop microchips bear about 1,000 miles of wires — it becomes non-trivial, especially when your car is trying to see that little old lady crossing the street.

You’ve got to do it all on one chip whenever you can. And often the chip cannot be made using the conventional silicon processes (known as CMOS) used to make logic chips by the billions.

The Analog Opportunity

And that is the analog challenge and opportunity. The need for these “analog gateway” chips, combining sensory abilities with logical processing is about to explode.

More than ever we have means, motive, and opportunity to link our logical machines to the sensory world.

The means is 5G: connections at least 20 times faster than the fastest wireless network available today and likely to accelerate.

The motive as always is the desire to create and communicate. Sure, AI, the grunt worker of the symbolic world — never tires, never rests, gets faster and stronger with every year on the job. It can compare more MRIs than any doctor and check your factory’s metrics faster than any foreman. But it can do this only if the sense data of the world has been captured and symbolized so the AI can do its job.

That leads us to the opportunity.

The opportunity is in all the firms that will enable the analog world to be captured for the digital machine and then enable that data to be transmitted at faster-than-ever speeds. This includes our portfolio company of the month.

Towerjazz Makes Big (and Very Little) Waves

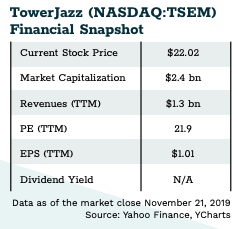

This month’s pick is specialist microchip foundry, TowerJazz Semiconductor (NASDAQ: TSEM).

Headquartered in Israel and headed by the visionary entrepreneur Russell Ellwanger, TSEM has now become the world’s leading fabrication plant for combining sensors and analog filters with digital processing on leading-edge hybrid chips.

Tower’s analog-to-digital hybrid devices will be crucial across the entire Internet of Things (IoT). But for now let’s just consider 5G wireless technology — a huge enabler of IoT. As 5G technology expands to the mainstream, it faces some real challenges that Tower is well positioned to solve.

5G Challenge #1: More Frequencies

5G networks depend on converting radio waves — phenomena as physical and analog as the nose on your face — into digital signals. The higher the frequency, or the broader the spread of frequencies employed, the more challenging the conversion, the more expensive and higher margin the hybrid chip that does the work.

5G networks will operate on two large pieces of the electromagnetic spectrum. In the sub 6GHz range, 5G will use spectrum already used for 4G, as well as additional frequencies either largely unused today or to be repurposed. Then it will also jump up into “millimeter wave” frequencies that no mobile phone uses today because of the technical challenges of very high frequency signals.

Even considering only “conventional” sub 6GHz frequencies, the technical opportunities are considerable. Expanding the choice of frequencies means increasing the number of antennas (tunable but only within a range) and thus the number of switches and low noise amplifiers (LNA). Among other issues, “frequency aggregation” (frequencies shared by various carriers to optimize data flow) increases the technical demands on all these components, pushing them toward high-end silicon on insulator (SOI), or silicon germanium (SIGE) processes.

Luckily, Tower is a leader in these processes.

5G Challenge #2: Can’t See Through Your Sofa

Adding millimeter wave frequencies increases both the challenges and potential of 5G. Shorter wavelengths and higher frequencies dramatically increase the amount of data that can be transmitted on a channel. High frequency channels, however, often require line-of-sight connections. And depending on the frequency, the channels may be blocked by walls, windows, your hand, or even a poorly placed sofa. To compensate for the line of sight/ sofa problem, high frequency 5G uses lots and lots of small transceivers rather than huge cell towers connecting directly to your phone. This will expand, perhaps exponentially, the demand for high-end radio components manufactured by the more exotic processes — at which Tower excels.

5G Challenge #3: Speed Kills

Very fast transmission speeds are challenging for the traditional silicon CMOS devices that dominate the digital world: The transmission tends to lose amplitude at high speeds. Silicon germanium devices do a better job of maintaining power. Yet very-high-speed signals require conditioning — processing — to maintain clarity. And that is a job for logic circuits for which CMOS is preferred. Thus, mixed-signal RF chips for high frequency transceivers require integration of digital logic with fast, highly linear analog signal processing. Tower manufactures hybrid devices combining silicon germanium transistors to maintain signal power, with CMOS area for logic to maintain signal integrity.

MEMS: Disturbing the Digital Signal

Tower also makes Microelectromechanical Machines (MEM). MEMs are curious hybrids. Though they are microchips, they are not truly solid state. They include very tiny moving parts. In a MEMs sensor the movement is a reaction to the phenomenon measured, whether it be pressure, temperature, acceleration (or deceleration triggering your airbag as your autonomous vehicle misbehaves.)

MEMs are already an important part of meeting the analog-to-digital, sensory-to-logical challenge because they are another way of integrating sensors onto logic chips. They are likely to become more important as frequencies rise. MEMs are likely the future for antenna tuners for high frequency 5G. Most MEMs are silicon “based.” They are manufactured with techniques pioneered by the makers of logic and memory chips, including very fine materials deposition and photo-lithography of circuit geometries smaller than the wavelengths of the light used to cut them. Incorporating the moving parts, however, adds complexities not contemplated in the mass manufacture of CMOS logic. Again — a job for analog and hybrid specialist chip makers such as Tower.

Tower is strong in high quality imaging and image recognition and components for smartphones with high pixel count cameras, where its main competition is Sony. Because Tower is an independent foundry, Tower customers do not have to worry that they are funding a competitor as they might be buying from Sony. Analog is different and so are analog foundries. A CMOS foundry is measured by a single standard: high-yield manufacturing of chips with increasingly small geometries (now as low as 7 nm) and increasingly dense circuitry.

Analog geometries are relatively large by contrast, though still much smaller than the CMOS geometries of even a decade ago. Now, 65 nm is practically speaking top of the line in analog today, though Tower and others can go even smaller. However, the larger geometries of analog chips do not imply an easier road. To take just one challenge, because analog signals vary continuously — as opposed to digital, on/off, 0/1 — electronic noise across the chip becomes critical.

To disturb a digital signal, noise must reach a well-defined threshold threatening to turn a zero into a one. In an analog chip, even much lower noise levels can distort the continuous signal and do so in ways that may not be obvious until the device is in prototype.

Add in such challenges as including moving parts in MEMs, or the integration of non-silicon materials or components, and the design of analog chips can be as challenging as their manufacture — in part because design and manufacture cannot really be separated.

In the physical world, true analog devices like your mercury thermometer or your doctor’s scale always have one and only one purpose: They are “Application Specific.”

Many analog chips are called Application Specific Integrated Circuits (ASICS). These are rarely as narrowly conceived as your thermometer, but they tend towards specificity as well. Over time, a given design may find such wide application as to become standard. Still, far more often than in the all-digital realm, an analog or hybrid designer is asked to build something that has never been built before. We speak glibly of integrating analog and digital circuits on a single chip. But an analog foundry may have to combine analog circuits, mixed-signal radio, high power, and power management devices on a single device.

“In the physical world, true analog devices like your mercury thermometer or your doctors scale always have one and only one purpose: They are ‘Application Specific.'”

As a result, leading edge analog designers must be joined at the hip to experts in semiconductor manufacturing processes, materials science, thermodynamics, and feedback and control mechanisms. They need to grasp the behavior, and misbehavior, of electrical circuits at a level far deeper than on and off.

For example, one of many complications is that analog functions often require circuits that can sustain much higher power than the 1.1 V to 5V limits of most digital circuits. Analog chips commonly handle 5V to 40V. And some analog devices can operate at much higher voltage and significant current.

The Resilience of Analog

Analog devices often function in environments far less friendly than your laptop or smart phone. They may encounter extremes of temperature and intimidating amounts of electronic noise from the energetic devices in which they are embedded, like your car.

All of this makes analog manufacturing extremely challenging. Fabricating digital devices, though far from easy, is relatively straightforward — combining a limited number of circuits, and relatively few considerations of the physics of the devices. Analog designers, on the other hand, must consider the whole realm of electrical device parameters — including gain, matching, noise, varying temperature and voltage tolerances on the same device, power dissipation and resistance.

Things such as parasitic devices, crosstalk, and substrate noise — hardly a consideration for digital design and manufacture — become crucial. The devices must be modeled for reliability across a large number of variables in the environment. A new logic device is supposed to run right the first time it comes off the line. Analog devices rarely do.

Analog veteran, Vice President at JVD, and occasional blogger Bob Frostholm, describes some of the challenges. He states that often:

“The Analog ASIC requirement is a completely new circuit… Just bidding on such a requirement may require several days or weeks of engineering evaluation to determine if what the customer is requesting is even feasible.”

In one recent project, a refinement of the signal conditioning capabilities of a MEMs sensor, “the customer’s requirement at first seemed unobtainable: three different manufacturers had declared it violated the laws of physics.” There was no current wafer fab process capable of meeting the design criteria. To build the device, the designers and the process engineers had to be on the same team, inventing processes to fulfill design, adjusting the design to the limits of process.

The best analog foundries — and Tower is the best — thus exemplify the Christensen rule: When you are pushing the limits of performance, every step in the process must be integrated.

Design and production must be intimate and interactive. Taiwan Semiconductor (TSMC), the greatest digital logic foundry in the world, manufactures chips for Qualcomm, Apple and even Intel which also has its own fabs. But TSMC does not design chips, because, except for geometry size — which the customer knows — digital design is largely insensitive to the fabrication process. By contrast, for Tower’s analog customers, the company’s integration of process and design team are indispensable.

The Peaks and Troughs of the Industry

Pundits have long proclaimed the chip business to be cyclical. They have even defined a “chip cycle,” confidently warning investors that the industry is approaching a peak or trough and advising them to act accordingly. There is some truth to this. But since 1959, those peaks and troughs have been little more than staggered steps on an upward path that has never halted.

The occasional downturns, in part, symbolize one of the long-term attractions of the industry. A powerful factor in creating the peaks and troughs is an inherent economic challenge that also creates durable barriers to entry and allows for long periods of exceptional profit. Building a new semiconductor fab takes several years and billions of dollars. TSMC estimates it spends more than $10 billion a year just keeping its existing fabs up to date. It projects that its next fab will cost $20 billion to build.

Tower invests over $200 million a year in capital expenditures. Its 7 fabs in three geographic regions across the world would cost many billions of dollars to duplicate today.

Necessarily, chip makers build capacity ahead of demand, and can go through cycles when some or all their fabs are running at 50% capacity or less, eroding profits. But as Zack’s analyst Lisa Thompson points out, the huge investment in fixed costs gives these firms tremendous operational leverage. As sales rise incrementally, the next chip sold comes at huge profit compared to the first chip sold. Gross profits rise very quickly. Thompsons estimates that every additional dollar of Tower revenue tends to add over $0.50 to gross margin. As the company adds more 12-inch (300 mm) wafer capacity, Thompson points out, operational leverage should grow.

It is the very challenges of analog design and fabrication that power the margins of analog foundries. A classic digital, CMOS foundry really competes only on one parameter: how much it can reduce circuit size and thus cost per circuit on a single chip. CMOS runs measure in millions, or hundreds of millions, of chips with margins declining over time. The complexities of fabbing analog chips, almost always in shorter runs than CMOS devices, justify not only high manufacturing charges but design charges as well.

How to Play Towerjazz

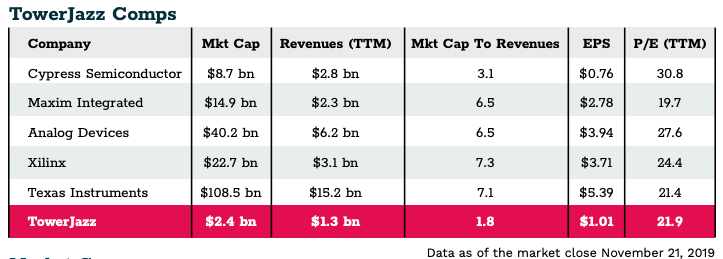

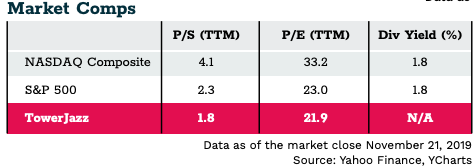

Measured by PE, Tower lags essentially all its competitors. The company went backwards on both revenues and profits in 2018, and this year still has not recovered to 2017 levels. Utilization rates remain low, though they have improved.

We have not found any indication that slackness is driven by customer dissatisfaction as opposed to that “semi-conductor cycle” that has proved over and over again to be an investment opportunity. The last time Tower revenues surged, the stock peaked at $35.67 which would represent a more than 60% gain from its current price.

We like Tower because we have always liked the foundry model. And in analog, we like pure-play because its special demands require focus.